1099-Nec Template For Preprinted Forms - Web step 1 answer a few simple questions to create your document. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). If all fields are filled out correctly, fabulous! Make small adjustments if needed. Web www.irs.gov/form1099nec (if checked) federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. Medical and health care payments. How to adjust printing position? Ezw2 software can prepare, print and efile forms w2, w3, 1096 and 1099. Used for the 2021 tax year only. The payer and the receiver should point their names, addresses, and taxpayers ids.

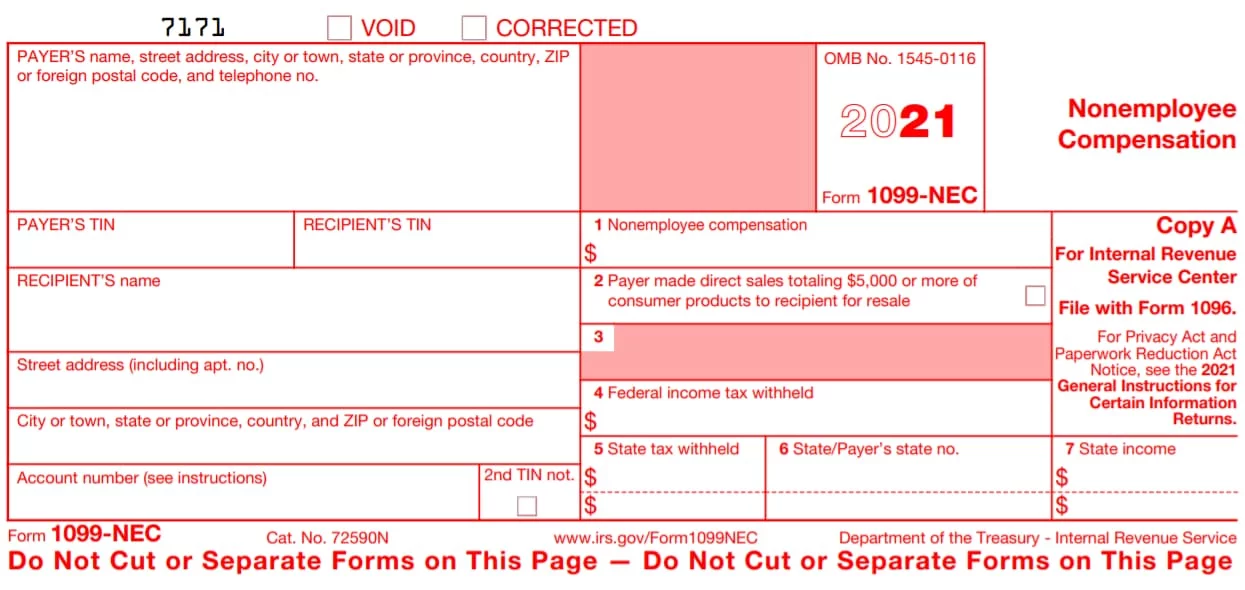

1099NEC Form 2023 2024

If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. 1.1 if you have not installed ezw2 software, you can download the trial version for free before purchasing. Step 3 download your document instantly. Boxes on.

How do I Access 1099NEC form Files for Use with Sage Checks & Forms?

These new “continuous use” forms no longer include the tax year. 1.2 after you installed ezw2 software, you can click desktop shortcut to start ezw2 software easily. How to adjust printing position? If you are printing with an inkjet printer, you will need to set the paper manually. Web step 1 answer a few simple questions to create your document.

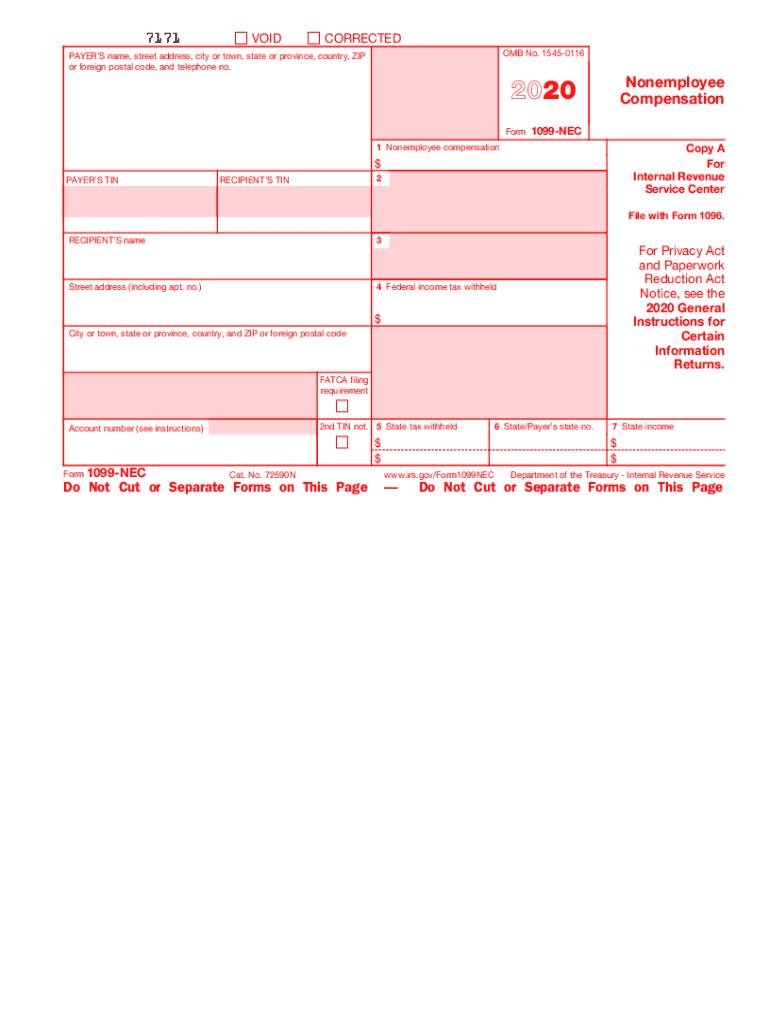

2020 QuickBooks 1099 NEC 3 Part Preprinted Tax Forms with Envelopes

Print to your paper 1099 or 1096 forms. How to adjust printing position? And on box 4, enter the federal tax withheld if any. Step 3 download your document instantly. Web to calculate and print to irs 1099 forms with their unconventional spacing.

Free Printable 1099 Nec Form 2022 Printable Word Searches

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Web step 1 answer a few simple questions to create your document. Make small adjustments if needed. Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and.

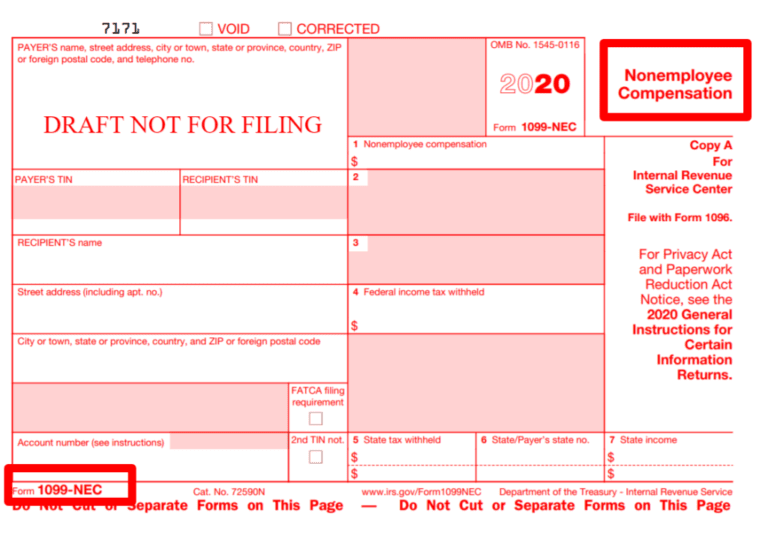

Blank 1099 Nec Form 2020 Printable Fill Out and Sign Printable PDF

You must use the official form. Form 1096 will be generate automatically. These new “continuous use” forms no longer include the tax year. Print to your paper 1099 or 1096 forms. Step 2 preview how your document looks and make edits.

How to File Your Taxes if You Received a Form 1099NEC

Pdf *the featured form (2022 version) is the current version for all succeeding years. Easily fill out pdf blank, edit, and sign them. Both the forms and instructions will be updated as needed. Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact number. Form 1096.

1099 Nec Form 2021 Fill and Sign Printable Template Online US Legal

Ezw2 software can prepare, print and efile forms w2, w3, 1096 and 1099. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). If all fields are filled out correctly, fabulous! Web to calculate and print to irs 1099 forms with their unconventional spacing. Medical and health care payments.

Fill out a 1099NEC

If you are printing with an inkjet printer, you will need to set the paper manually. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. If all fields are filled out correctly, fabulous! Pdf *the featured form (2022 version) is the current version for all succeeding years. Make small adjustments if needed.

1099 Nec Form 2020 Printable Fill Out and Sign Printable PDF Template

If all fields are filled out correctly, fabulous! Medical and health care payments. Save or instantly send your ready documents. I finally got to the qef and filed electronically. Ezw2 software can prepare, print and efile forms w2, w3, 1096 and 1099.

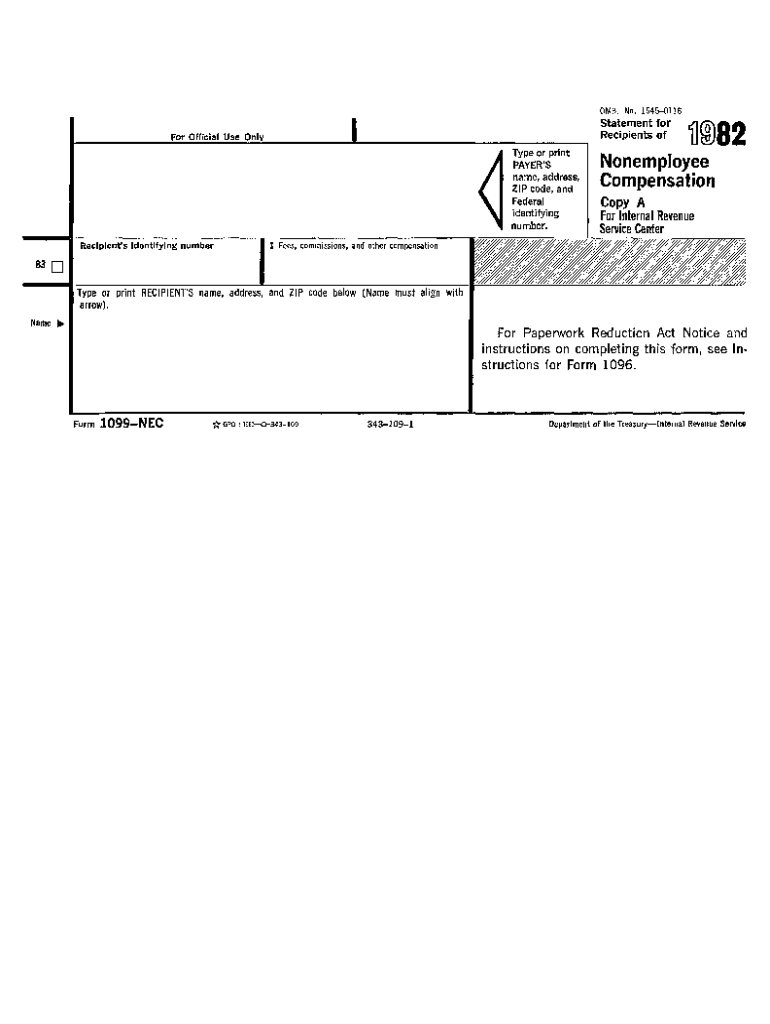

Form 1099NEC Instructions and Tax Reporting Guide

If all fields are filled out correctly, fabulous! 1.2 after you installed ezw2 software, you can click desktop shortcut to start ezw2 software easily. Web step 1 answer a few simple questions to create your document. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Web the irs specifically states that you must use the red forms so that.

Both the forms and instructions will be updated as needed. Form 1096 will be generate automatically. Pdf *the featured form (2022 version) is the current version for all succeeding years. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. 1.2 after you installed ezw2 software, you can click desktop shortcut to start ezw2 software easily. And on box 4, enter the federal tax withheld if any. Make small adjustments if needed. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. If you are printing with an inkjet printer, you will need to set the paper manually. Ezw2 software can prepare, print and efile forms w2, w3, 1096 and 1099. Print to your paper 1099 or 1096 forms. Web to calculate and print to irs 1099 forms with their unconventional spacing. These new “continuous use” forms no longer include the tax year. Save or instantly send your ready documents. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact number. Download this 2022 excel template. The box 1 allows to indicate the amount of money was compensated during the past tax year. If all fields are filled out correctly, fabulous! Web www.irs.gov/form1099nec (if checked) federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs.