Asc 842 Lease Amortization Schedule Template - A roadmap to adoption and implementation. The entry to record the lease upon its commencement is a debit to rou asset and a credit to lease liability: Web in turn, your new asc 842 journal entries to recognize the commencement of this lease will be as follows: Lease accounting is like a tale of two cities, with companies that have adopted asc 842 in one and those that have not yet adopted the standard in the other. Asc 842 disclosure report example; Web with this lease amortization schedule you will be able to : The only exception is if the lease is less than twelve months long. Financing leases schedule and guide; And as always, your financial friends at embark are here to help guide the way. Credit of $112,000 under the lease liability account.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

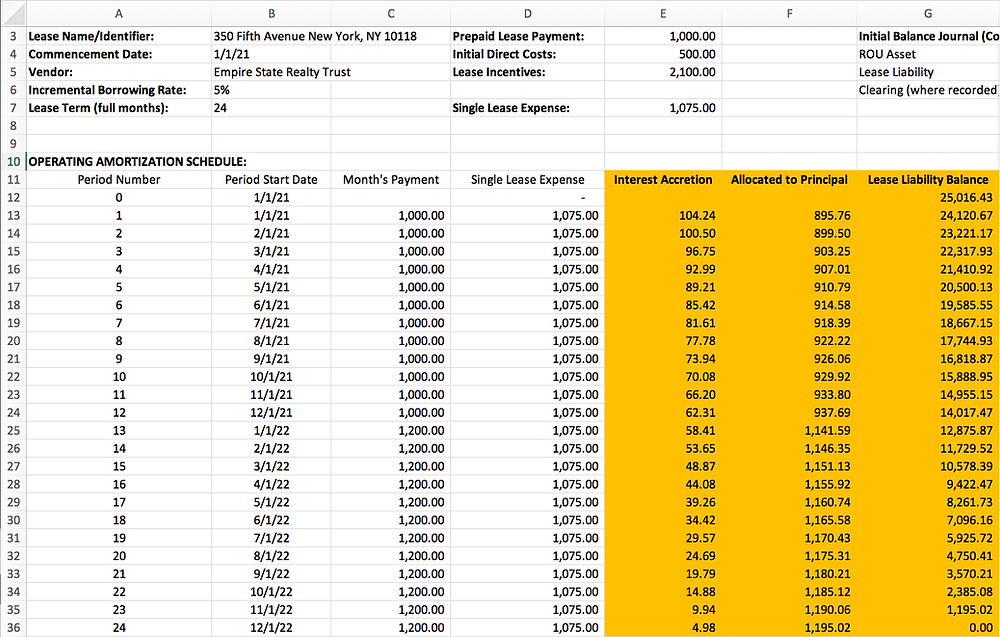

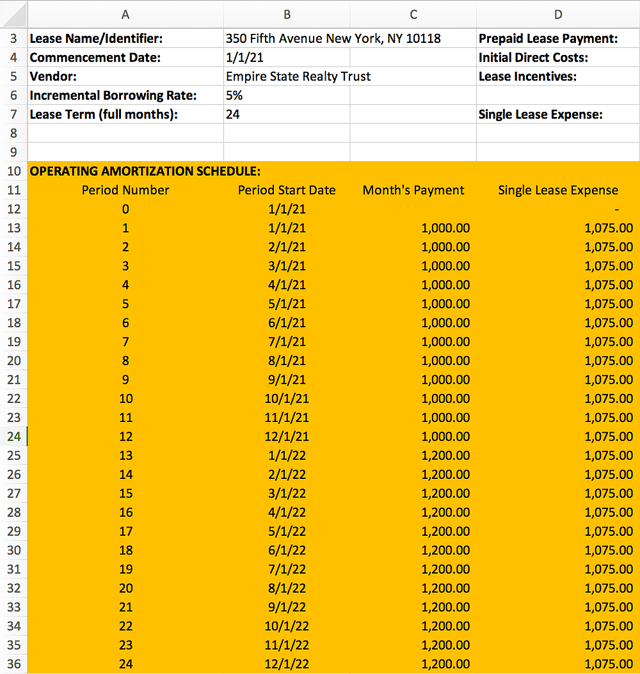

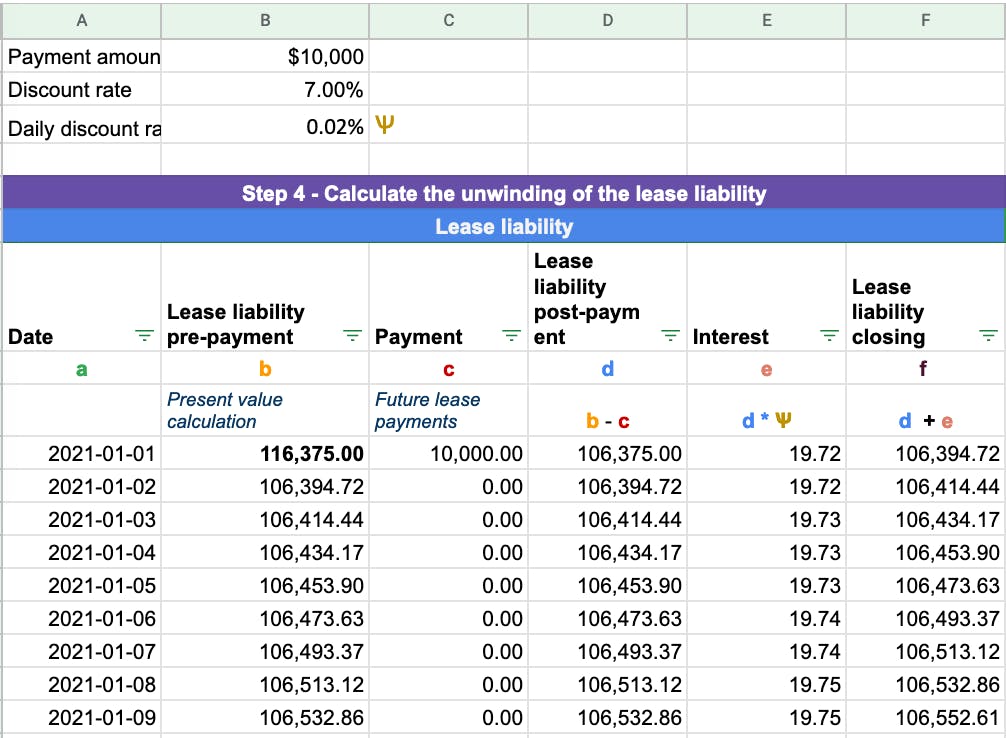

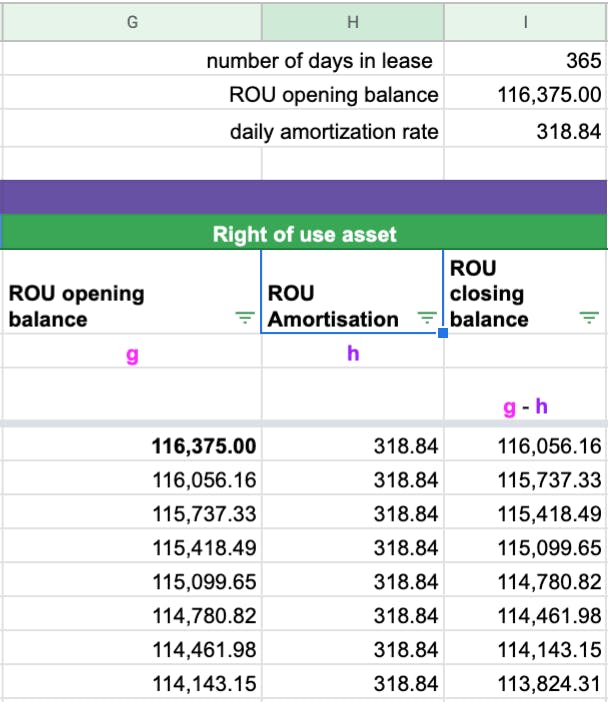

Web download our simple asc 842 compliant lease amortization schedule template. This schedule reflects the gradual reduction of the lease liability balance over time. Lease accounting is like a tale of two cities, with companies that have adopted asc 842 in one and those that have not yet adopted the standard in the other. Web under asc 842, regardless of.

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Lease accounting is like a tale of two cities, with companies that have adopted asc 842 in one and those that have not yet adopted the standard in the other. This is a big difference from asc 840! At the end of each year, the company’s tax team asks the lease accounting team for the amount of that $100,000 tia.

Lease Modification Accounting under ASC 842 Operating Lease to

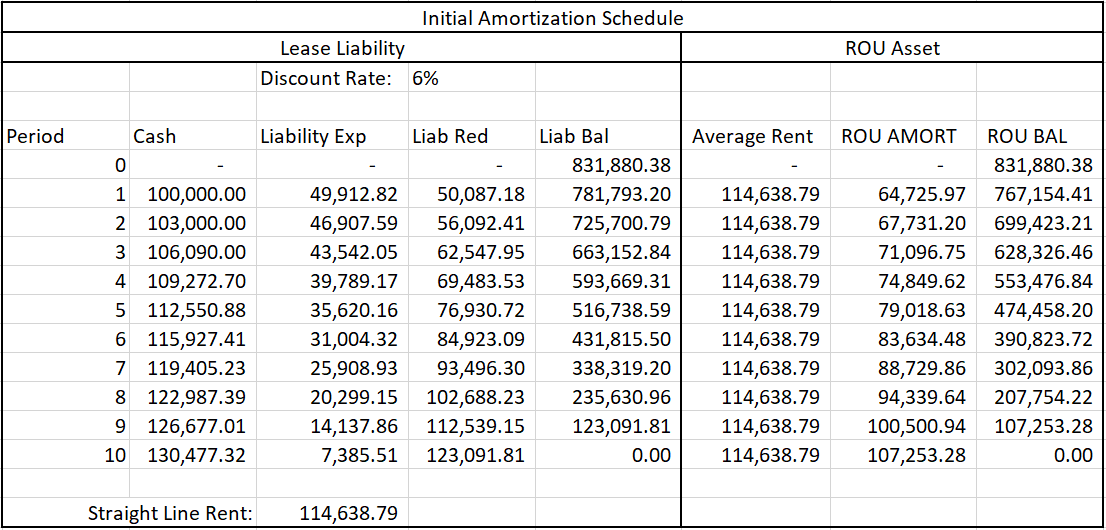

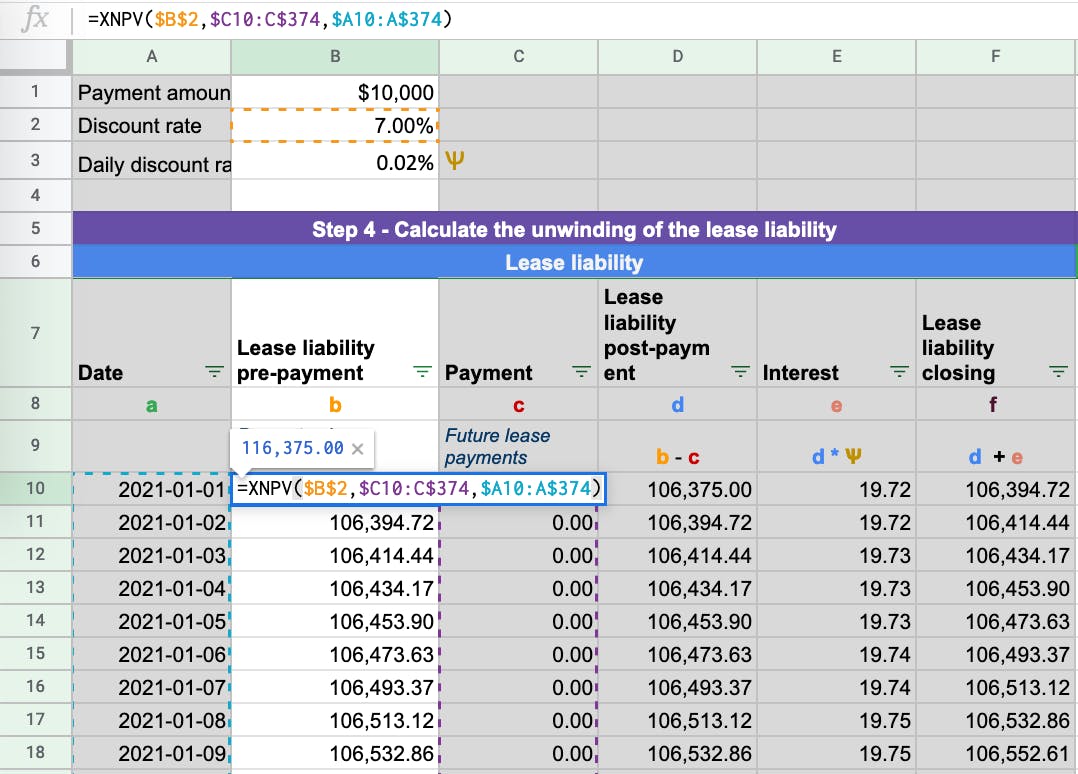

With our excel template, you will be guided on how to calculate your lease amortization schedules for both lease types. Calculate your monthly lease liabilities and rou assets in compliance with asc 842. Asc 842 transition blueprint & workbook; The fundamental idea is to break down the net present value of all future lease payments into manageable. Web the asc.

How to Calculate a Finance Lease under ASC 842

Web asc 842 rules require the tia to be included as part of the rou asset and to be amortized over the term of the lease. Subsequent entries follow the amounts set forth in the amortization table. A roadmap to adoption and implementation. Financing leases schedule and guide; The entry for the annual activity of 2023 is below.

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Calculate your monthly lease liabilities and rou assets in compliance with asc 842. Debit of $112,000 under the rou asset account. Fill out the form below to get our template. A roadmap to adoption and implementation. Web a lease amortization schedule is designed to outline the timing of lease payments and allocate them between principal and interest components.

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

At the end of each year, the company’s tax team asks the lease accounting team for the amount of that $100,000 tia that is currently part of the rou asset. Asc 842 disclosure report example; The fundamental idea is to break down the net present value of all future lease payments into manageable. When tallying figures for the balance sheet,.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Learn how to use it in our step by step blog post and give it a try. Determine the total lease payments under gaap. Web for each lease that is covered under 842 you’ll need to create an amortization schedule based on the classification of the lease (finance or operating). The asc 842 lease classification template for lessees is now.

How to Calculate a Finance Lease under ASC 842

With our excel template, you will be guided on how to calculate your lease amortization schedules for both lease types. A roadmap to adoption and implementation. Web the asc 842 leasing standard. Web in turn, your new asc 842 journal entries to recognize the commencement of this lease will be as follows: At the end of each year, the company’s.

How to Calculate a Finance Lease under ASC 842

This may be useful for practitioners to test and document the results. This is a big difference from asc 840! At the end of each year, the company’s tax team asks the lease accounting team for the amount of that $100,000 tia that is currently part of the rou asset. The fundamental idea is to break down the net present.

ASC 842 Guide

Financing leases schedule and guide; The entry to record the lease upon its commencement is a debit to rou asset and a credit to lease liability: Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. Web another acceptable approach to subsequently account for the lease is to retain the linkage.

Web how to calculate your lease amortization. It can be used as a standalone asc 842 lease solution, or in conjunction with leasing software. And as always, your financial friends at embark are here to help guide the way. Learn how to use it in our step by step blog post and give it a try. Web with this lease amortization schedule you will be able to : When tallying figures for the balance sheet, the lease liability and rou asset accounts are now included. Web download this asc 842 lease accounting spreadsheet template as we going you through how you capacity easily create an operating lease schedule that meets the requirements under asc 842, whether financing or operating. Operating vs finance lease journal entries examples; Credit of $112,000 under the lease liability account. Given the lease is for a stipulated period, the right of use asset must go to zero when the lessee no longer has control over the leased asset. Financing leases schedule and guide; With our excel template, you will be guided on how to calculate your lease amortization schedules for both lease types. Fill out the form below to get our template. Web the amortization schedule for this lease is below. The basic 842lease.com spreadsheet is designed to be very simple and user friendly. How to record a finance lease and journal entries Web download our simple asc 842 compliant lease amortization schedule template. If the tia is built directly into the amortization schedule and the. Using spreadsheets to comply with fasb's asc 842 and ifrs 16 is complex and difficult to manage, but if you only have a few leases, it is possible. Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842.