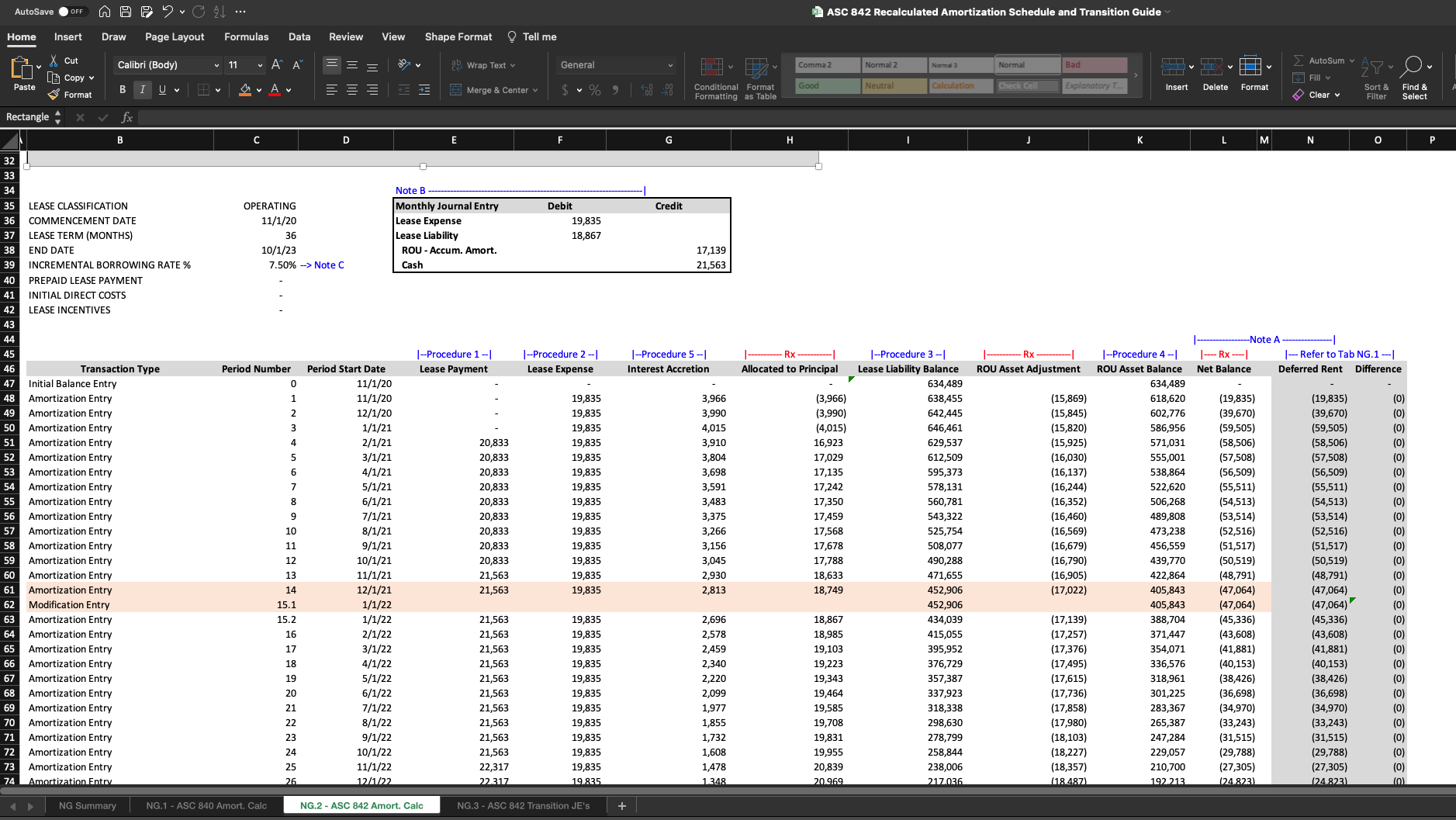

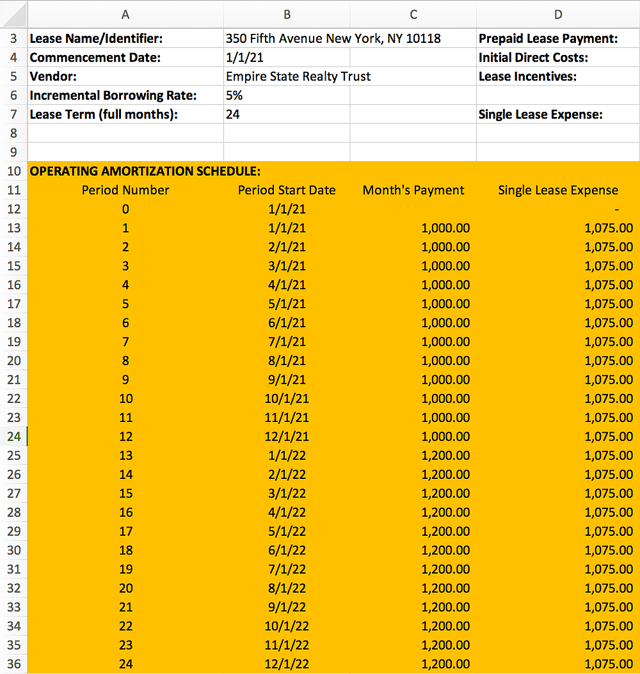

Asc 842 Lease Excel Template Free - Use this free tool to determine if your contract contains a lease. Web larson lease accounting template asc 842. Web download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842). If you're unsure, refer to our initial recognition guidance. Your excel worksheet needs to include a way to calculate these journal entries on a monthly, or at minimum, quarterly basis. Create a new excel spreadsheet and title five columns with the following headers: Web download our simple asc 842 compliant lease amortization schedule template. Calculate your monthly lease liabilities and rou assets in compliance with asc 842. The user merely answers the lease and lease type determination questions derived straight from the asc 842 language. Keep in mind that our software solution, netlease, automates all of these steps and delivers the required disclosures for asc 842, ifrs 16 and gasb 87 compliance.

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

What’s covered and what’s not covered? Use this free tool to determine if your contract contains a lease. Create five columns within the excel worksheet. Which is amortized over the useful life of the asset. Asc 840 accounting would be better described as the deficit or surplus of your total cash payments in comparison to your lease expense over a.

Sensational Asc 842 Excel Template Dashboard Download Free

The implicit rate at the date of lease inception is specified as the preferred discount rate in the standard. Then the spreadsheet proposes a lease type. Effective date for private companies. The lessee's right to use the leased asset. While you are creating the reoccurring entries, don’t.

Lease Modification Accounting under ASC 842 Operating Lease to

Web larson lease accounting template asc 842. Web give it a try on your own, or download our free asc 842 lease amortization schedule spreadsheet template. Web asc 842 led to changes in the accounting of lease contracts and is a challenge for many companies. What’s covered and what’s not covered? Interest rate implicit in the lease under ifrs 16.

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

The free excel template from contavio helps you understand the leases rules and shows you how to calculate contracts. Effective date for public companies. Web asc 842 led to changes in the accounting of lease contracts and is a challenge for many companies. For accountants, accounting managers, controllers, auditors, and finance executives. The asc 842 lease classification template for lessees.

ASC 842 Excel Template Download

The implicit rate at the date of lease inception is specified as the preferred discount rate in the standard. Operating lease accounting under asc 842 and. Web how to calculate your lease amortization. Web asc 842 lease classification template for lessees. Web this solution will suffice for entities with around a dozen or less leases or a cpa firm validating.

5 Steps To ASC 842 Lease Compliance EZLease

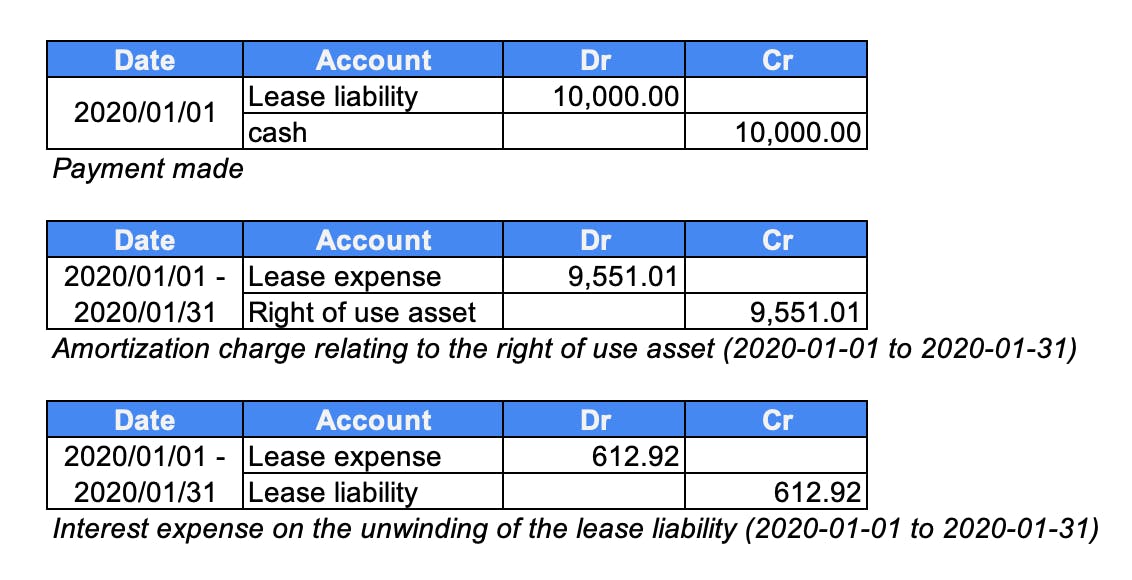

What is a lease under asc 842? Your excel worksheet needs to include a way to calculate these journal entries on a monthly, or at minimum, quarterly basis. Learn how to use it in our step by step blog post and give it a try. Web larson lease accounting template asc 842. Create five columns within the excel worksheet.

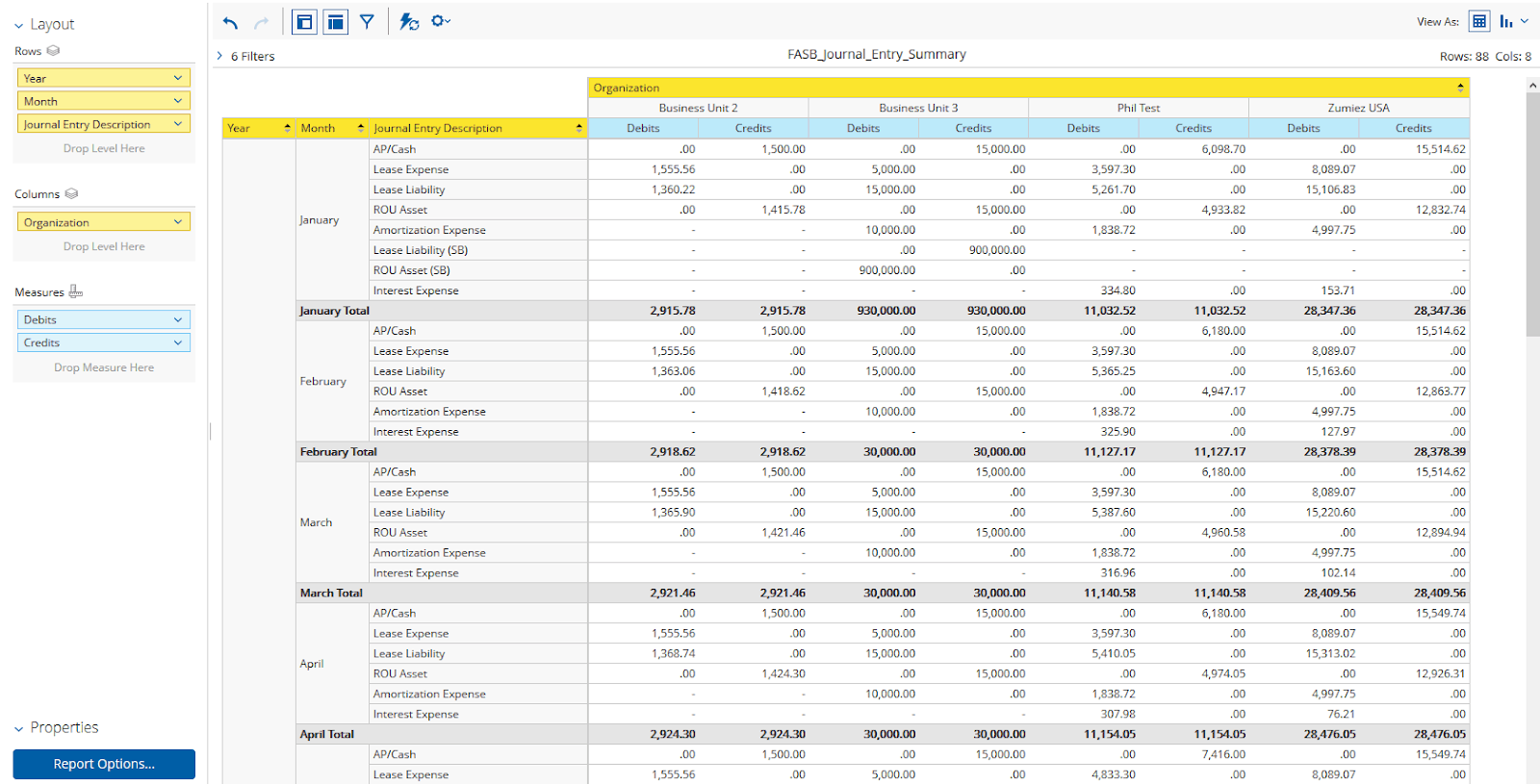

ASC 842 Journal Entries for Finance & Operating Leases Visual Lease

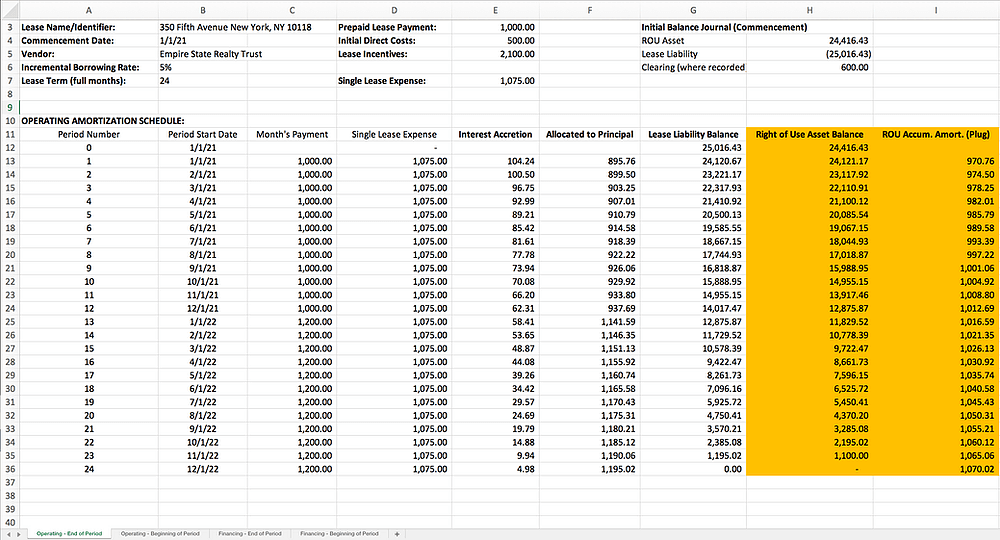

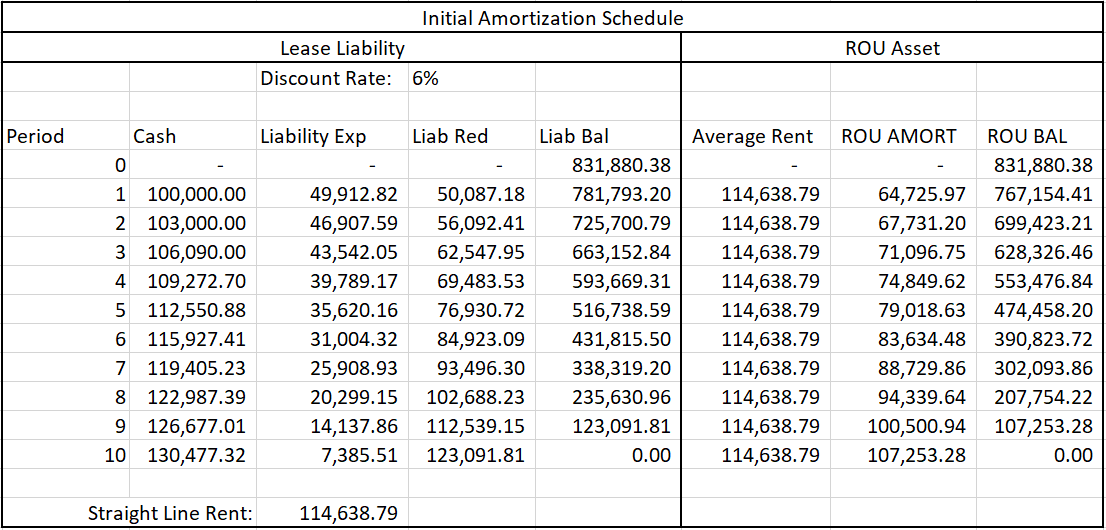

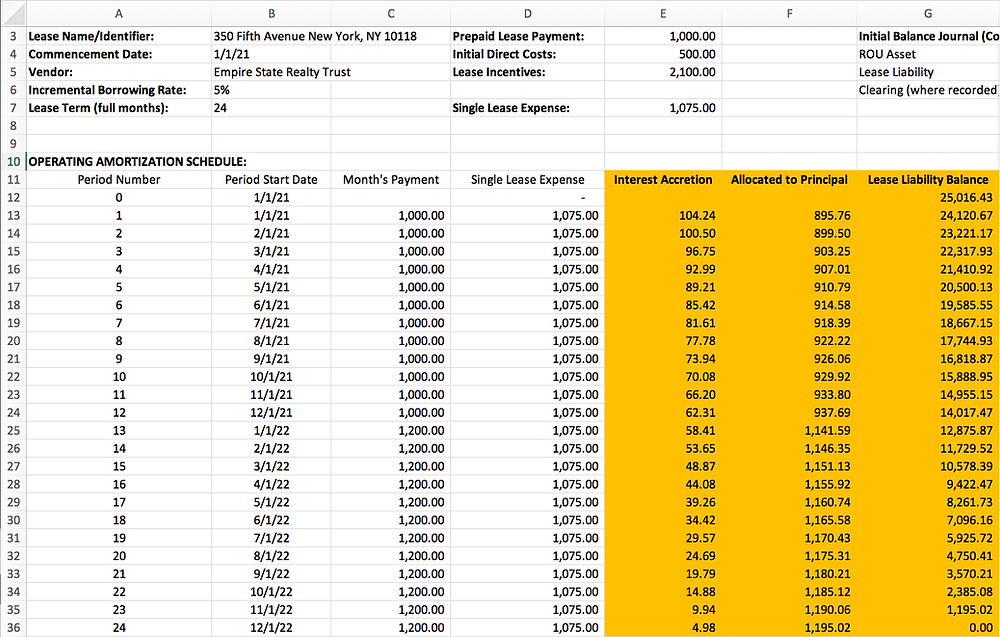

Fill out the form below to get our template. With our excel template, you will be guided on how to calculate your lease amortization schedules for both lease types. Web excel templates for operating and financing leases under asc 842. Keep in mind that our software solution, netlease, automates all of these steps and delivers the required disclosures for asc.

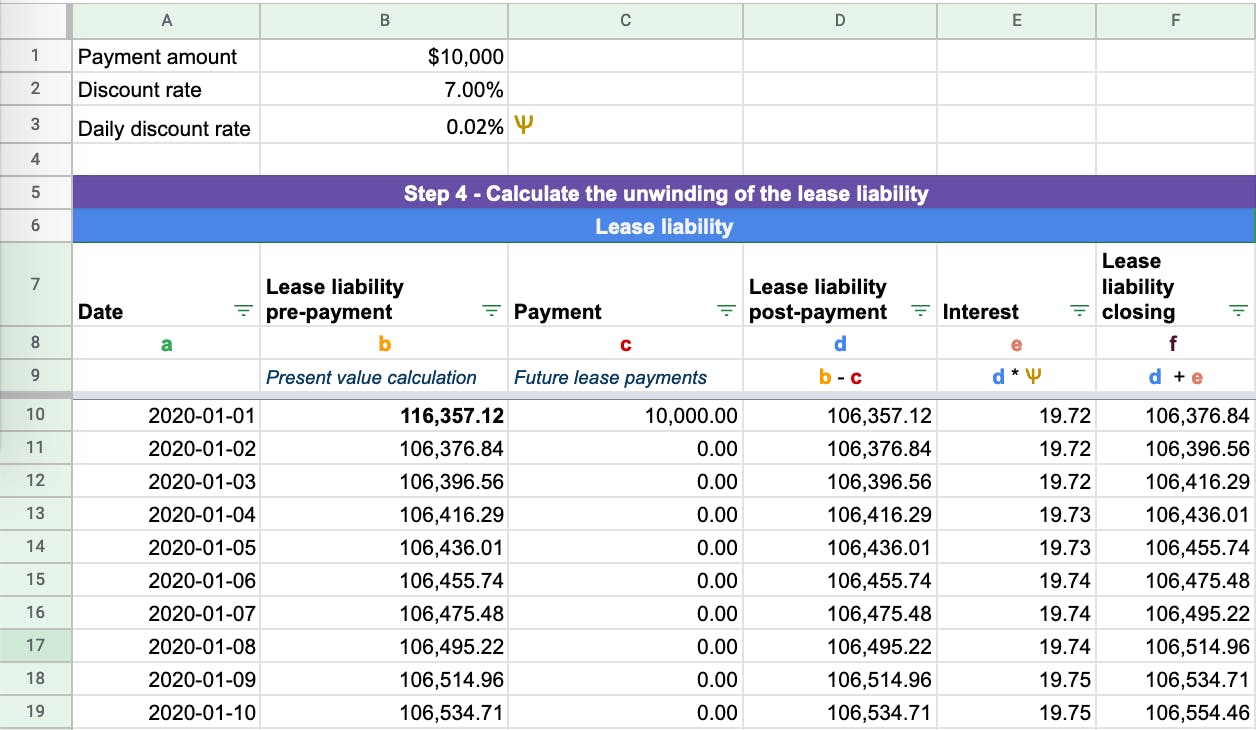

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Which is amortized over the useful life of the asset. With this lease amortization schedule you will be able to : Reference additional instructions for more details on the terms and calculations. Web discount rate implicit in the lease under asc 842. While you are creating the reoccurring entries, don’t.

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Web discount rate implicit in the lease under asc 842. Learn how to use it in our step by step blog post and give it a try. Period, cash, expense, liability reduction, and liability balance, as shown below: Web asc 842 lease classification template for lessees. Your company is also required to use this rate if it’s available.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Create five columns within the excel worksheet. Web use this free tool to determine if your leases are classified as finance or operating leases under asc 842. Keep in mind that our software solution, netlease, automates all of these steps and delivers the required disclosures for asc 842, ifrs 16 and gasb 87 compliance. Web with everything we’ve provided, we.

Web with everything we’ve provided, we hope you have a better understanding of the new standards for lessees, are far less nervous about them now, and proceed with confidence. Your excel worksheet needs to include a way to calculate these journal entries on a monthly, or at minimum, quarterly basis. Each row will include the date of the payment and the payment amount for the life of the lease. Use this free tool to create an inventory of your leases. Web give it a try on your own, or download our free asc 842 lease amortization schedule spreadsheet template. My take on the “why” we are switching to asc 842: Web download this asc 842 lease accounting spreadsheet template as we walk you through how you cannot easily make certain operating lease date that meets the application available asc 842, whether financing or operating. Or, try it for free. The free excel template from contavio helps you understand the leases rules and shows you how to calculate contracts. The lessee's right to use the leased asset. Period, cash, expense, liability reduction, and liability balance, as shown below: Web the rate component of the present value calculation is also called the discount rate, and your company has a few options to choose from as it applies asc 842. Web this solution will suffice for entities with around a dozen or less leases or a cpa firm validating client provided lease calculations. Web here's that excel template again: Using spreadsheets to comply with fasb's asc 842 and ifrs 16 is complex and difficult to manage, but if you only have a few leases, it is possible. For accountants, accounting managers, controllers, auditors, and finance executives. The implicit rate at the date of lease inception is specified as the preferred discount rate in the standard. If you're unsure, refer to our initial recognition guidance. Asc 840 accounting would be better described as the deficit or surplus of your total cash payments in comparison to your lease expense over a. Web use this free tool to determine if your leases are classified as finance or operating leases under asc 842.