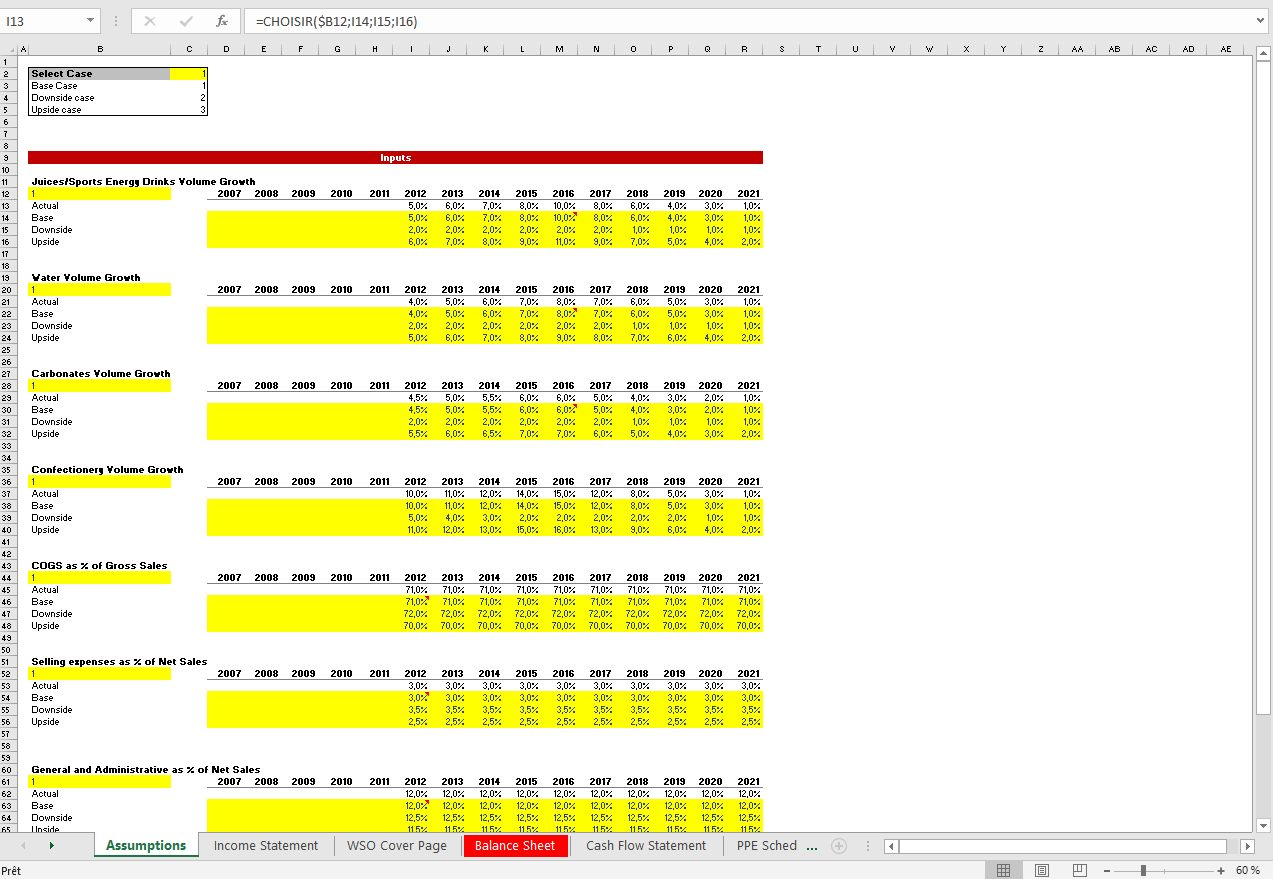

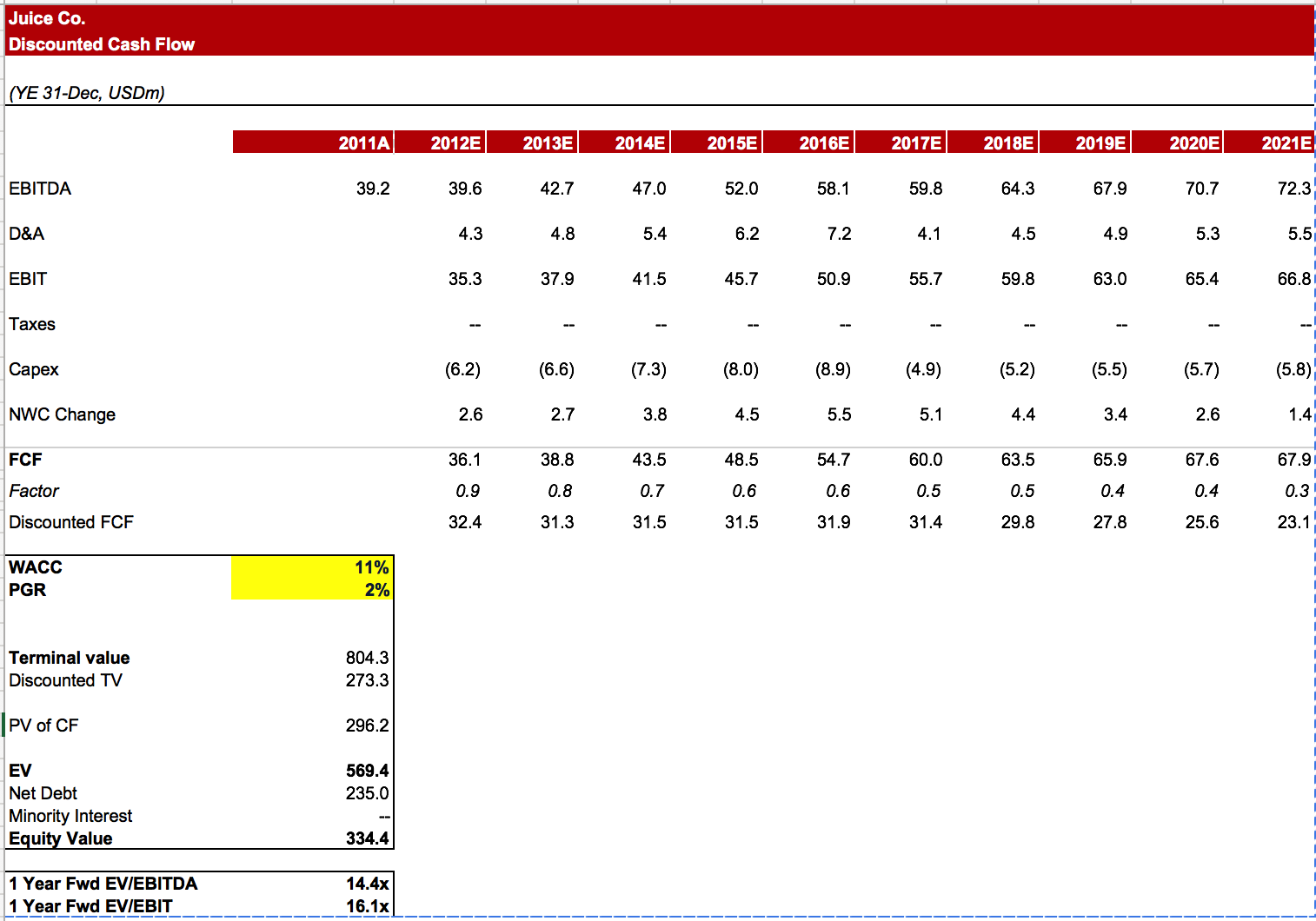

Dcf Model Excel Template - Start your dcf analysis today! Start free trial to access template. Use the form below to download our sample dcf model template: Join 307,012+ monthly readers mergers & inquisitions Financial model templates which contain a dcf model. This template allows you to build your own discounted cash flow model with different assumptions. Web before we begin, download the dcf template. We’ll now move to a modeling exercise, which you can access by filling out the form below. So what does a dcf entail and why do we use it? This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions.

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Suppose a company generated $100 million in revenue in the trailing twelve months ( ttm) period. Enter your name and email in the form below and download the free template now! Web click here to download the dcf template. =npv(discount rate, series of cash flows) this formula assumes that all cash flows received are spread over equal time periods, whether.

Discounted Cash Flow (DCF) Model Excel Template Eloquens

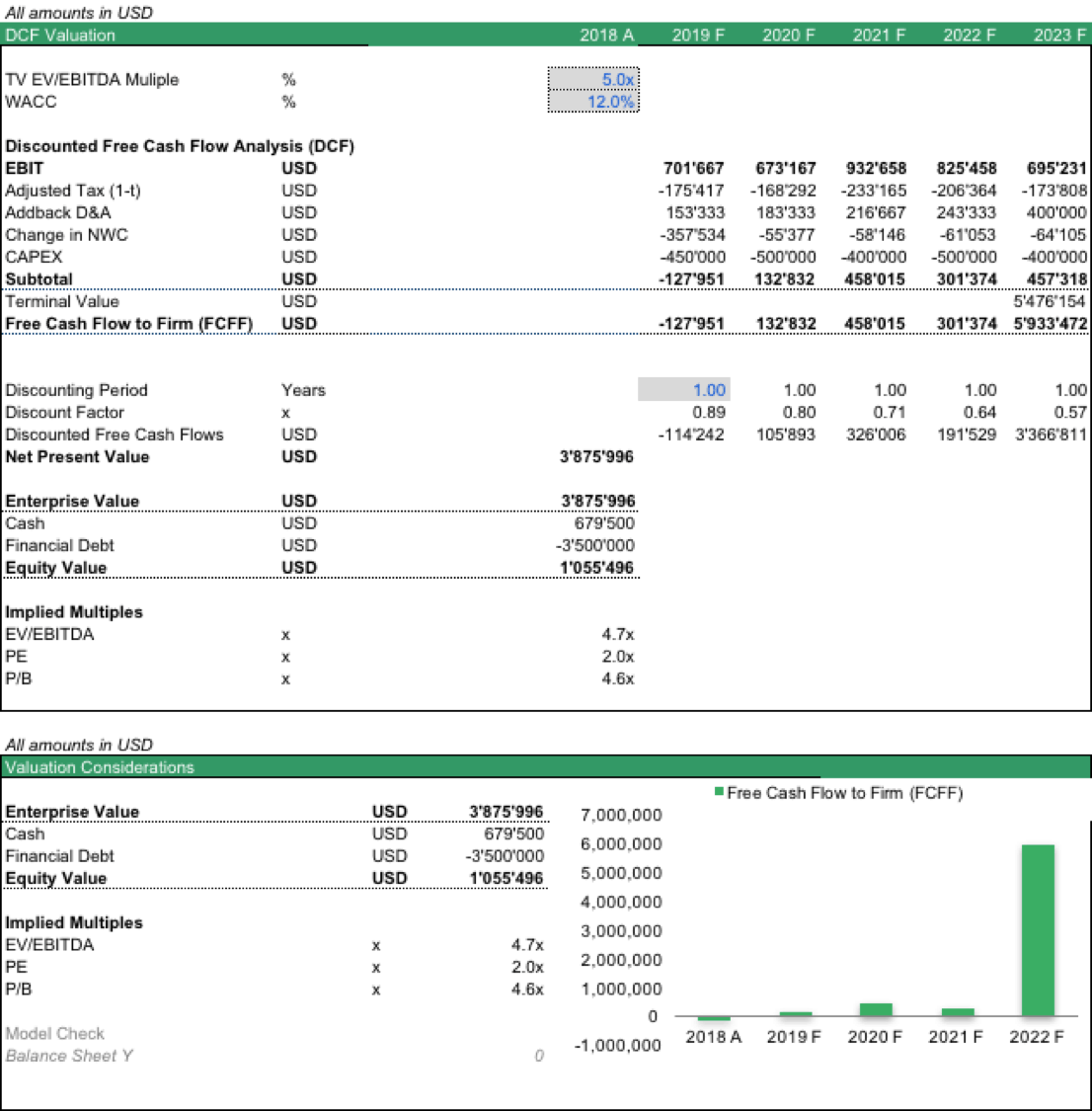

Web download free template. Use the form below to get the excel model template to follow along with this lesson. The template uses the discounted cash flow (dcf) method, which discounts future cash. Dcf models discount expected free cash flows and calculate their net present value (npv). Web the dcf template is an excel spreadsheet that allows you to input.

DCF Model Training 6 Steps to Building a DCF Model in Excel Wall

=npv(discount rate, series of cash flows) this formula assumes that all cash flows received are spread over equal time periods, whether years, quarters, months, or otherwise. Web sample discounted cash flow excel template. Web the dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic value of a stock. Its principal.

DCF model Discounted Cash Flow Valuation eFinancialModels

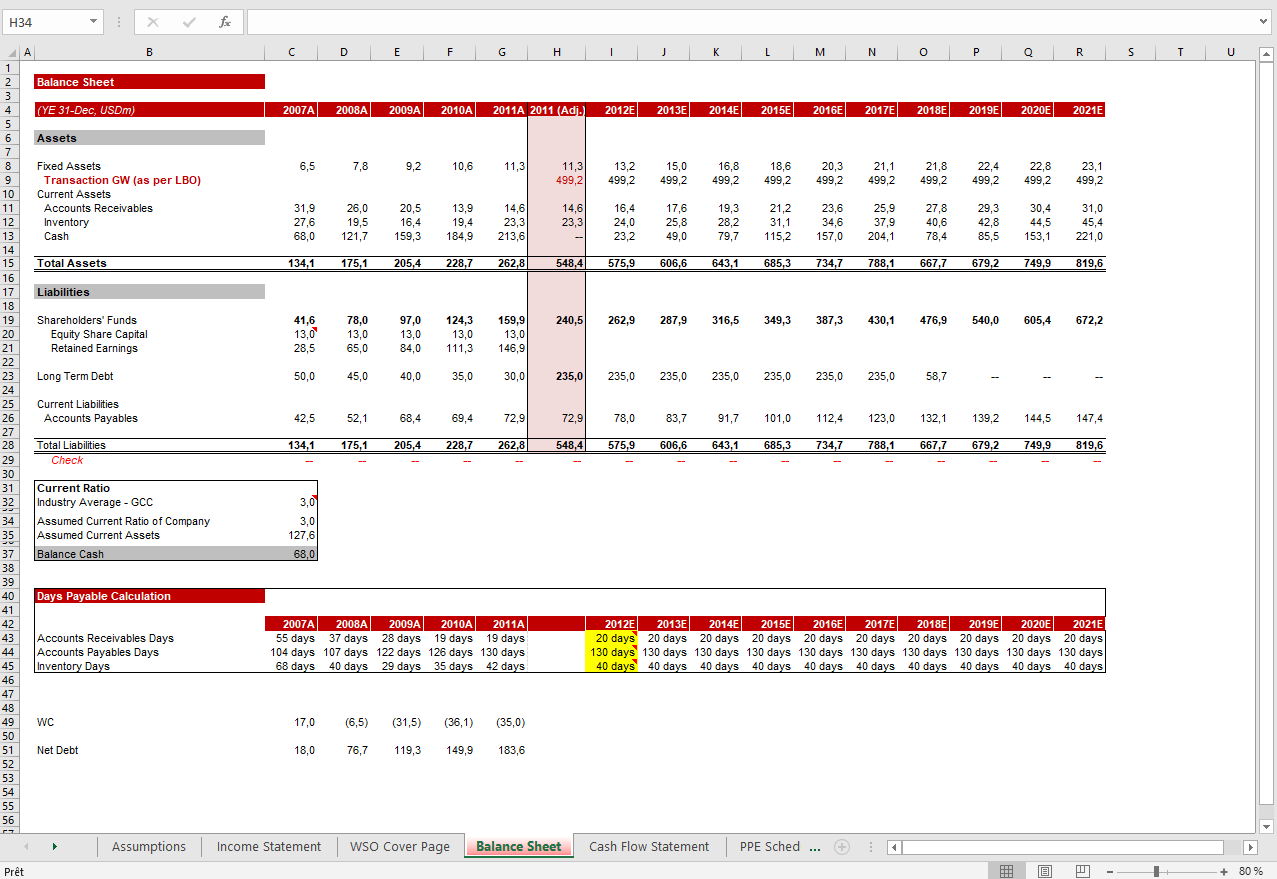

* dashboard, * income statement, * cash flow, * balance sheet, * wacc calculation, * dcf calculation, * liquidity. Web a dcf model is a specific type of financial modeling tool used to value a business. So what does a dcf entail and why do we use it? Finance to obtain financial statement data. Web dcf formula in excel.

DCF Discounted Cash Flow Model Excel Template Eloquens

The discounted free cash flow (dcf) method is a widely accepted valuation method. Web click here to download the dcf template. To do this, dcf finds the present value of future cash flows using a discount rate. Web before we begin, download the dcf template. Web sample discounted cash flow excel template.

DCF Model Full Guide, Excel Templates, and Video Tutorial (2022)

Web dcf formula in excel. Price reviews downloads publication date last updated. Finance to obtain financial statement data. Use the form below to download our sample dcf model template: Use this checklist to track a child’s progress and share insights with parents.

Discounted Cash Flow (DCF) Excel Model Template Eloquens

This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Ensure that each child's full name is written accurately. So what does a dcf entail and why do we use it? I have 20 years of experience in project management and business development background, and with the help of my.

Discounted Cash Flow (DCF) Model Template Wall Street Oasis

Start free trial to access template. This sample dcf excel template provides you with an easily scannable view of your company’s or investment’s true value by using the time value of money (tvm), which refers to the preferred benefit of receiving money presently rather than a similar sum at a future date. So what does a dcf entail and why.

Excel Discounted Cash Flow (DCF) Analysis Model with IRR and NPV Eloquens

Web unlevered free cash flow is used to remove the impact of capital structure on a firm’s value and make companies more comparable. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Web sample discounted cash flow excel template. Reverse dcf model operating assumptions. It includes an example to.

DCF model tutorial with free Excel

The premise of the dcf model is that the value of a business is purely a function of its future cash flows. Web click here to download the dcf template. Join 307,012+ monthly readers mergers & inquisitions It includes an example to help you apply the calculations and is available for instant download. This dcf model training guide will teach.

Finance to obtain financial statement data. Dcf models discount expected free cash flows and calculate their net present value (npv). Financial model templates which contain a dcf model. List the names of all the children attending the program or facility for that day. Use the form below to download our sample dcf model template: Web before we begin, download the dcf template. Dcf stands for d iscounted c ash f low, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is called the net present value (npv). Price reviews downloads publication date last updated. Browse and select your desired template from our extensive library. Web download free template. The template uses the discounted cash flow (dcf) method, which discounts future cash. Then, conveniently generate and send a copy of this sheet to parents in pdf, excel, and web formats. Use the form below to get the excel model template to follow along with this lesson. Web unlevered free cash flow is used to remove the impact of capital structure on a firm’s value and make companies more comparable. The macabacus tab > new > sample models. This discounted cash flow (dcf) model, is a powerful tool designed to provide a detailed financial analysis. (if you’ve already downloaded the excel template file from part 1, you’re all good — this lesson uses the same file). * please consult sec filings, bloomberg, or google/yahoo! A basic dcf model involves projecting future cash flows and discounting them back to the present using a discount rate that reflects the riskiness of the capital. Download wso's free discounted cash flow (dcf) model template below!