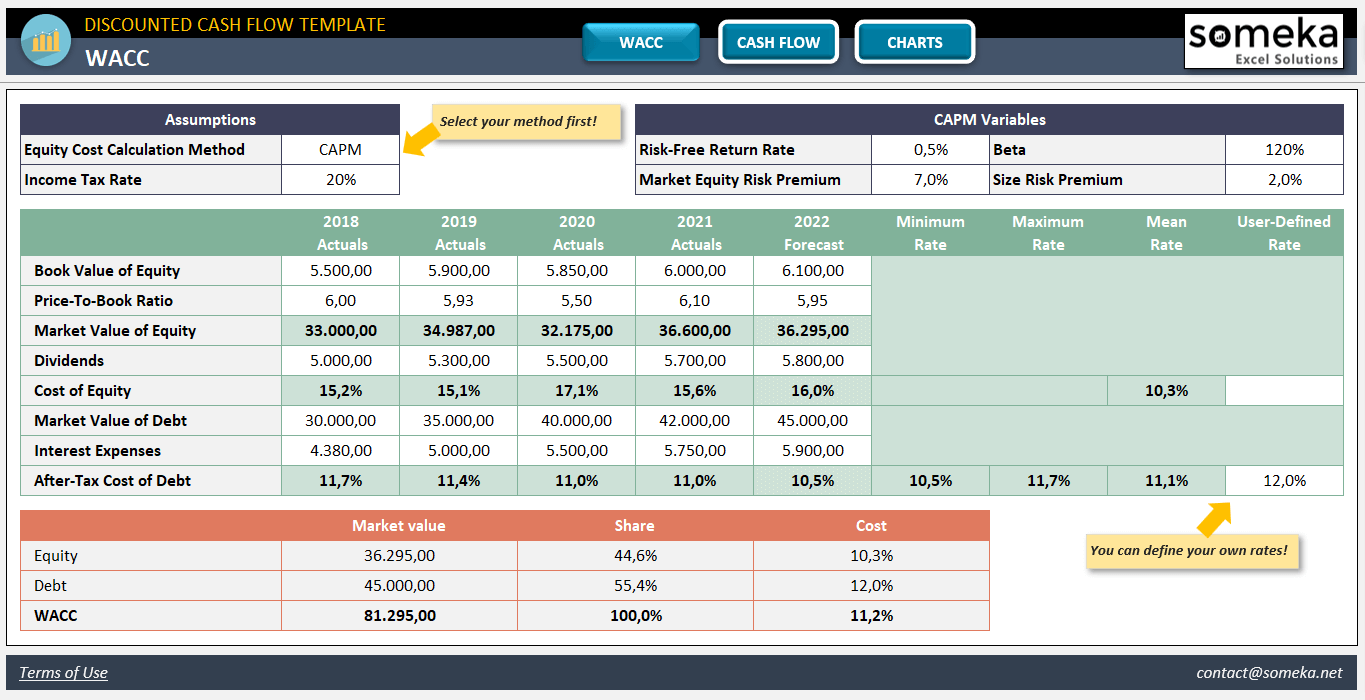

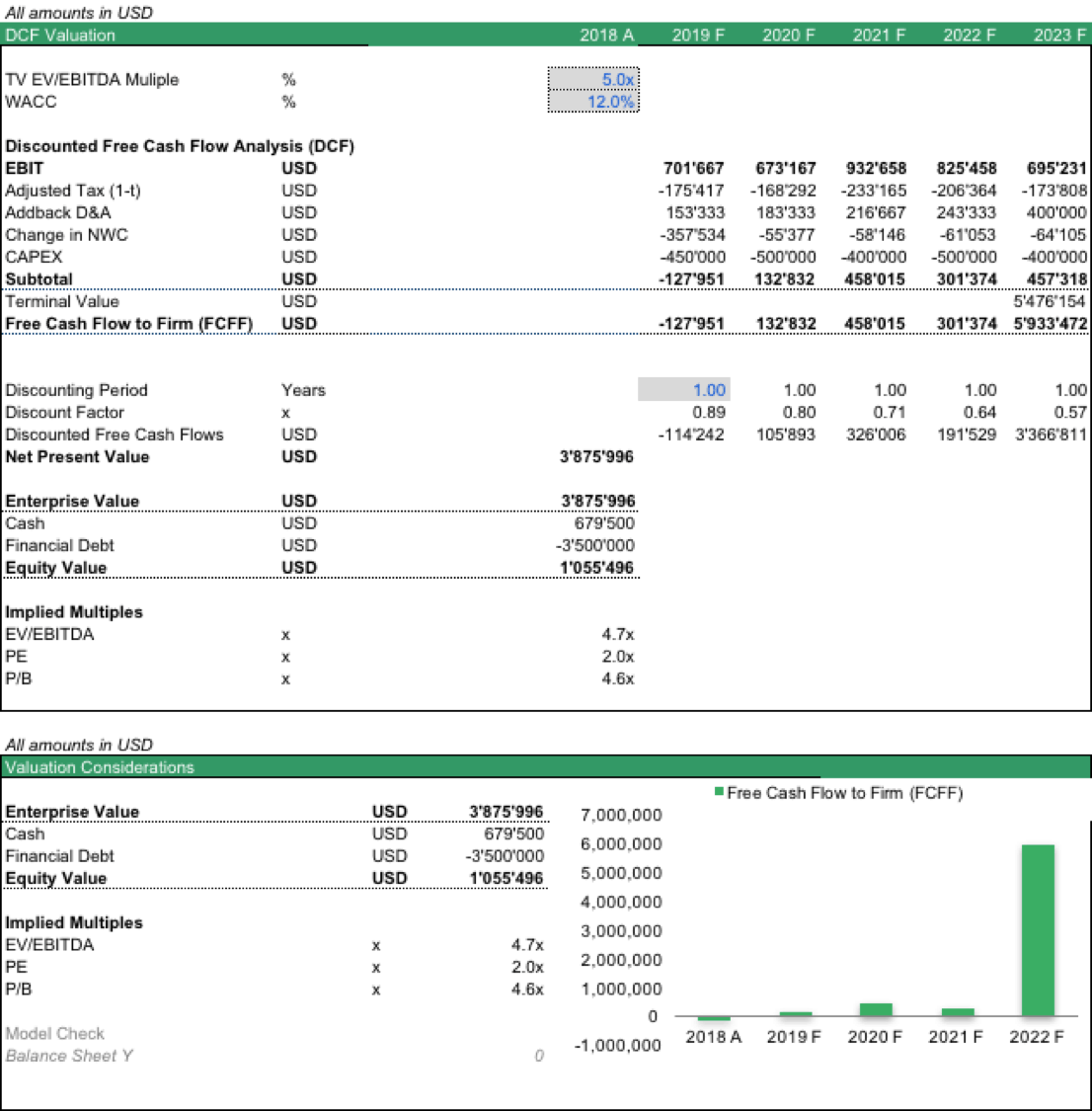

Dcf Valuation Excel Template - Discount the projection period and terminal cash flows to the present using the discount rate. Helps to find intrinsic value. Input the valuation date, discount rate, perpetual growth rate, and tax rate. Updated on october 16, 2023. This template allows you to build your own discounted cash flow model with different assumptions. In conclusion, nvidia should be worth $133.73 per share under our base case. Web this spreadsheet reconciles a cost of capital dcf valuation with an eva valuation of the same company : English [auto] what you'll learn. Web #1 discounted cash flow modeling in excel. Download wso's free discounted cash flow (dcf) model template below!

Discounted Cash Flow Excel Template DCF Valuation Template

This dcf model template provides you with a basics to build your own strongly cash flow model are different assumptions. Web * valuations (dcf, ddm, comparable comps) * 12+ hours of video. Read this excel tutorial to find out how you can easily estimate the net present value of your holdings with our free template, step by step. 4.4 (12.

DCF model Discounted Cash Flow Valuation eFinancialModels

Web download now the dcf valuation model free excel template. Web #1 discounted cash flow modeling in excel. Web * valuations (dcf, ddm, comparable comps) * 12+ hours of video. How to build a dcf model: Join 307,012+ monthly readers mergers & inquisitions

Valuation Model (DCF) (Excel) Financial analysis, Workbook, Business

Written by brooke tomasetti | reviewed by subject matter experts. Web net operating loss, free flow, and unlevered free cash flow factors give you an accurate picture of your company’s dcf actual valuation to ensure your company or investment is represented with an accurate financial projection. * please consult sec filings, bloomberg, or google/yahoo! The template comes with various scenarios.

how to calculate the future value in excel Valuation template business

The template uses the discounted cash flow (dcf) method, which discounts future cash. In conclusion, nvidia should be worth $133.73 per share under our base case. Read this excel tutorial to find out how you can easily estimate the net present value of your holdings with our free template, step by step. The executive summary also provides a quick overview.

DCF model Discounted Cash Flow Valuation eFinancialModels

Web the dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic value of a stock. Forecast the company's key financials and calculate the corresponding free cash flows. Web dcf model template. Pros and cons of using dcf model. Next, they link the three financial statements together so that they are.

Discounted Cash Flow (DCF) Model Macabacus

Web dcf model template. Below is a preview of the dcf model master: Helps to find intrinsic value. * please consult sec filings, bloomberg, or google/yahoo! Web #1 discounted cash flow modeling in excel.

DCF Model Full Guide, Excel Templates, and Video Tutorial (2022)

Web download now the dcf valuation model free excel template. * please consult sec filings, bloomberg, or google/yahoo! Updated on october 16, 2023. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Web our discounted cash flow valuation template is designed to.

DCF model tutorial with free Excel

Important during mergers and acquisitions. Updated on october 16, 2023. Finance to obtain financial statement data. This spreadsheet allows you to reconcile the differences between the gross debt and net debt approaches to. This dcf model training guide will teach you the basics, step by.

![Free DCF Template Excel [Download & Guide] Wisesheets Blog](https://cdn-eaclf.nitrocdn.com/osNuHhBvVdZeEkSNJhSMrIuyqQJMcjPL/assets/static/optimized/rev-09e077f/wp-content/uploads/2022/07/Screen-Shot-2022-07-03-at-11.57.05-AM-1024x539.png)

Free DCF Template Excel [Download & Guide] Wisesheets Blog

Learn financial modeling techniques with fundamental analysis to value a company and design 3 financial statements. Download wso's free discounted cash flow (dcf) model template below! Download sample discounted cash flow excel template — excel. Discover the intrinsic value of any company using our free discounted cash flow (dcf) template. Our discounted cash flow template in excel will help you.

Valuation Model (DCF) (Excel workbook (XLS)) Flevy

How to build a dcf model: Web this dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Read this excel tutorial to find out how you can easily estimate the net present value of your holdings with our free template, step by step. * please consult sec filings, bloomberg, or.

Download wso's free discounted cash flow (dcf) model template below! Web the dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic value of a stock. This spreadsheet allows you to reconcile the differences between the gross debt and net debt approaches to. Download sample discounted cash flow excel template — excel. This dcf model template provides you with a basics to build your own strongly cash flow model are different assumptions. Our discounted cash flow template in excel will help you to determine the value of the investment and calculate how much it will be in the future. The premise of the dcf model is that the value of a business is purely a function of its future cash flows. * please consult sec filings, bloomberg, or google/yahoo! The executive summary also provides a quick overview of the whole dcf excel template. Next, they link the three financial statements together so that they are dynamically connected. Input the valuation date, discount rate, perpetual growth rate, and tax rate. Use the form below to download our sample dcf model template: Web dcf model template. Discount the projection period and terminal cash flows to the present using the discount rate. It includes an example to help you apply the calculations and is available for instant download. Web download now the dcf valuation model free excel template. Web dcf stands for d iscounted c ash f low, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is called the net present value (npv). Learn financial modeling techniques with fundamental analysis to value a company and design 3 financial statements. Below is a preview of the dcf model master: Written by brooke tomasetti | reviewed by subject matter experts.