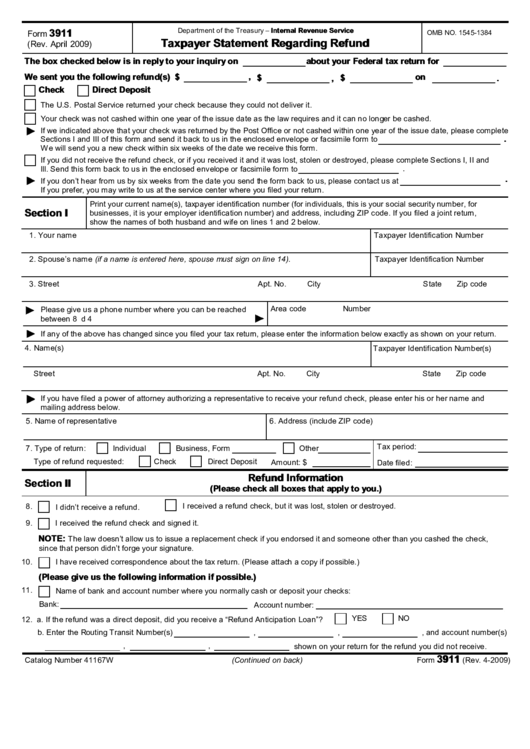

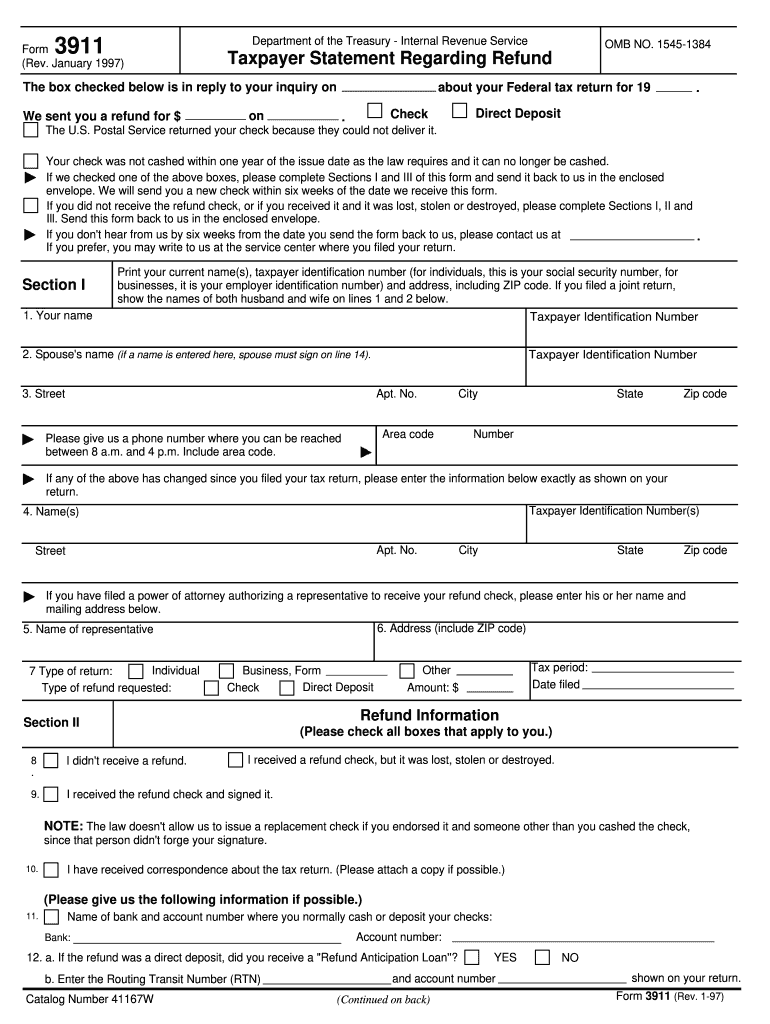

Irs Form 3911 Printable - If needed, the irs will issue a replacement check. Web 21.4.2.4.1 form 3911, taxpayer statement regarding refund 21.4.2.4.2 input command code (cc) chkcl 21.4.2.4.3 processing the command code (cc) chkcl trace request 21.4.2.4.4 responding to taxpayer's subsequent inquiries 21.4.2.4.5 disposition status. Get ready for tax season deadlines by completing any required tax forms today. Web download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the replacement process started. Your claim for a missing refund is processed one of two ways: The leading editor is right at your fingertips offering you various useful tools. Web go to “where’s my refund?” at irs.gov or use the irs2go mobile app and follow the prompts to begin a refund trace. If your filing status is married filing jointly. Ad download or email irs 3911 & more fillable forms, register and subscribe now! By filing this form, the taxpayer initiates a refund trace.

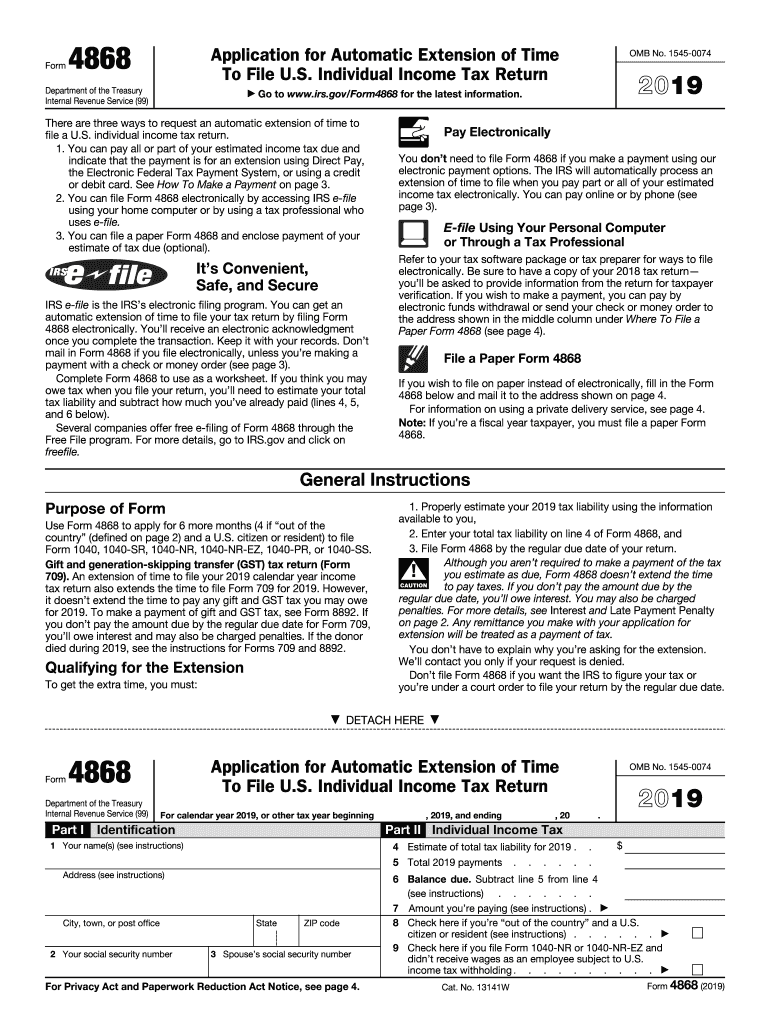

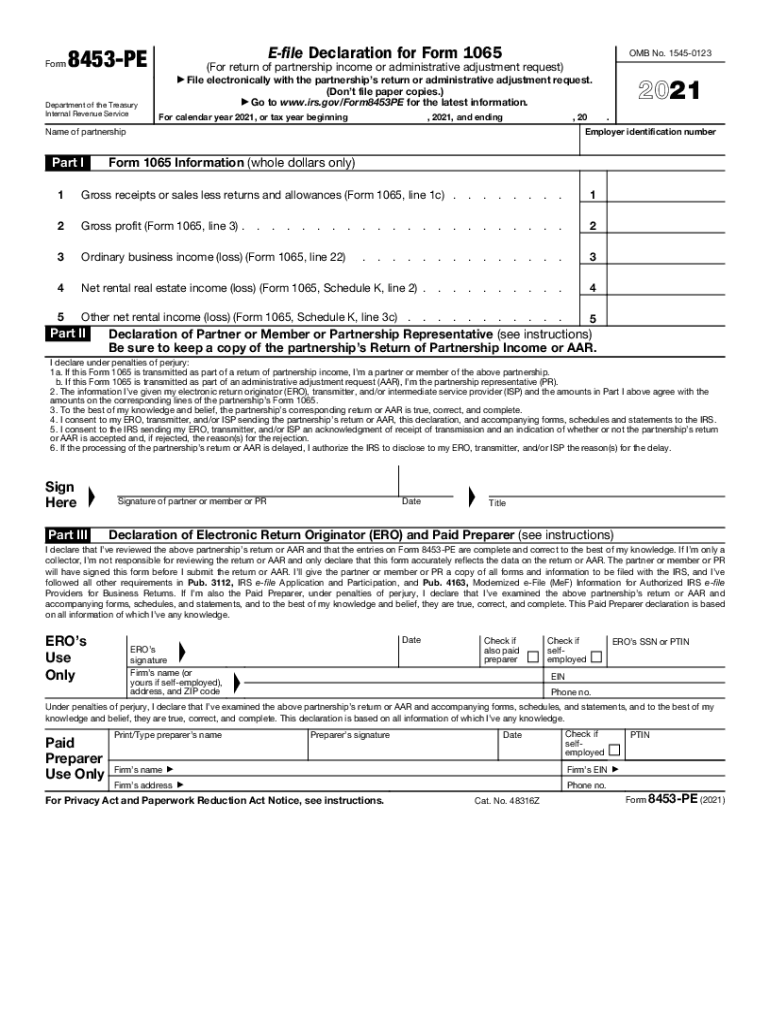

2019 Form IRS 4868 Fill Online, Printable, Fillable, Blank pdfFiller

Draw your signature, type it, upload its image, or use your mobile device as a. This section is to be filled out by everyone without exception. Save or instantly send your ready documents. Ad download or email irs 3911 & more fillable forms, register and subscribe now! You need to complete form 3911, taxpayer statement regarding refund, and mail it.

Irs Form 3911 Printable Printable World Holiday

By filing this form, the taxpayer initiates a refund trace. Web form 3911 can be filed with the irs to inquire about a lost, damaged, stolen, or otherwise missing federal tax refund payment. The form is typically used to track down missing tax refunds. Type text, add images, blackout confidential details, add comments, highlights and more. You can also download.

20182022 Form IRS 3911 Fill Online, Printable, Fillable, Blank pdfFiller

You can also download it, export it or print it out. Web go to “where’s my refund?” at irs.gov or use the irs2go mobile app and follow the prompts to begin a refund trace. By filing this form, the taxpayer initiates a refund trace. This form is for income earned in tax year 2022, with tax returns due in april.

Form 3911 Taxpayer Statement Regarding Refund (Fillible) printable

You can also download it, export it or print it out. Form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer service representative. Save or instantly send your ready documents. Type text, add images, blackout confidential details, add comments, highlights and more. First, you.

Irs Form 3911 Printable Printable World Holiday

Your claim for a missing refund is processed one of two ways: The times of frightening complex tax and legal documents have ended. First, you need to download the irs form 3911 from the internal revenue service. Type text, add images, blackout confidential details, add comments, highlights and more. Web 21.4.2.4.1 form 3911, taxpayer statement regarding refund 21.4.2.4.2 input command.

2021 Internal Revenue Service Form Fill Out and Sign Printable PDF

Show details how it works browse for the 3911 form customize and esign irs form 3911 send out signed form 3911 or print it what makes the 3911 form legally. Ad download or email irs 3911 & more fillable forms, register and subscribe now! We last updated the taxpayer statement regarding refund in december 2022, so this is the. First,.

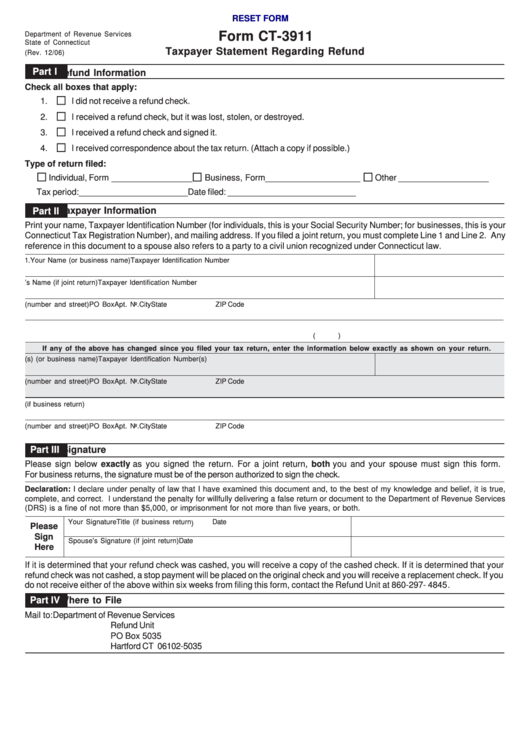

2006 Form CT CT3911 Fill Online, Printable, Fillable, Blank pdfFiller

The form is typically used to track down missing tax refunds. Show details how it works browse for the 3911 form customize and esign irs form 3911 send out signed form 3911 or print it what makes the 3911 form legally. Ad download or email irs 3911 & more fillable forms, register and subscribe now! Easily fill out pdf blank,.

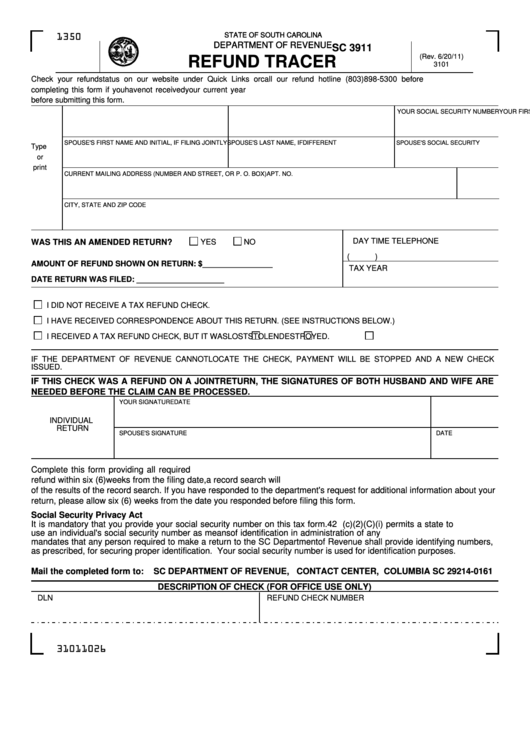

Form Sc 3911 Refund Tracer 2011 printable pdf download

Enter your full name, tin, physical address, telephone number, and the type of return, including expected amount, and tax year. You need to complete form 3911, taxpayer statement regarding refund, and mail it to the. We last updated the taxpayer statement regarding refund in december 2022, so this is the. While predominantly used for tax refunds, form 3911 has also.

Form 3911 Taxpayer Statement Regarding Refund (2012) Free Download

We last updated the taxpayer statement regarding refund in december 2022, so this is the. Web form 3911 can be filed with the irs to inquire about a lost, damaged, stolen, or otherwise missing federal tax refund payment. If your filing status is married filing jointly. Complete, edit or print tax forms instantly. While predominantly used for tax refunds, form.

941 Worksheet 1 2020 Fillable Pdf

Web irs form 3911 (taxpayer statement regarding refund) is what the irs sends you if you do not receive your expected income tax refund. If your filing status is married filing jointly. While predominantly used for tax refunds, form 3911 has also been utilized for missing economic impact. Show details how it works browse for the 3911 form customize and.

Web form 3911 can be filed with the irs to inquire about a lost, damaged, stolen, or otherwise missing federal tax refund payment. Download the irs form 3911. Web download and complete the form 3911, taxpayer statement regarding refund pdf or the irs can send you a form 3911 to get the replacement process started. Enter your full name, tin, physical address, telephone number, and the type of return, including expected amount, and tax year. Get ready for tax season deadlines by completing any required tax forms today. Form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer service representative. The form is typically used to track down missing tax refunds. The leading editor is right at your fingertips offering you various useful tools. Web follow the simple instructions below: Web 21.4.2.4.1 form 3911, taxpayer statement regarding refund 21.4.2.4.2 input command code (cc) chkcl 21.4.2.4.3 processing the command code (cc) chkcl trace request 21.4.2.4.4 responding to taxpayer's subsequent inquiries 21.4.2.4.5 disposition status. Web irs form 3911 (taxpayer statement regarding refund) is what the irs sends you if you do not receive your expected income tax refund. By filing this form, the taxpayer initiates a refund trace. Type text, add images, blackout confidential details, add comments, highlights and more. Web form 3911 is completed by the taxpayer to provide the service with information needed to trace the nonreceipt or loss of the already issued refund check. This section is to be filled out by everyone without exception. You can also download it, export it or print it out. Web what is a form 3911, taxpayer statement regarding refund? If needed, the irs will issue a replacement check. Current revision form 3911, taxpayer statement regarding refund (october 2022). Show details how it works browse for the 3911 form customize and esign irs form 3911 send out signed form 3911 or print it what makes the 3911 form legally.