Real Estate Discounted Cash Flow Model Excel Template - The procedure is used for real estate valuation and consists of three steps: Below is a preview of the dcf model template: Web the formula states this: Enter your name and email in the form below and download the free template now! Establish the required total return. This dcf model training guide will teach you the basics, step. Start by creating a table with the following columns: Web we’ve compiled the most useful free discounted cash flow (dcf) templates, including customizable templates for determining a company’s intrinsic value, investments, and real estate based on expected future cash flows. Web ms excel has two formulas that can be used to calculate discounted cash flow, which it terms as “npv.” regular npv formula: Web thomas brock an analysis using discounted cash flow (dcf) is a measure that's very commonly used in the evaluation of real estate investments.

Discounted Cash Flow Excel Template DCF Valuation Template

Free support & projections review. Because the reason you should invest today’s dollar is to bring in more value. This dcf model training guide will teach you the basics, step. Forecast the expected future cash flows. In the “year” column, list the years of the projected cash flows.

Free Discounted Cash Flow Templates Smartsheet

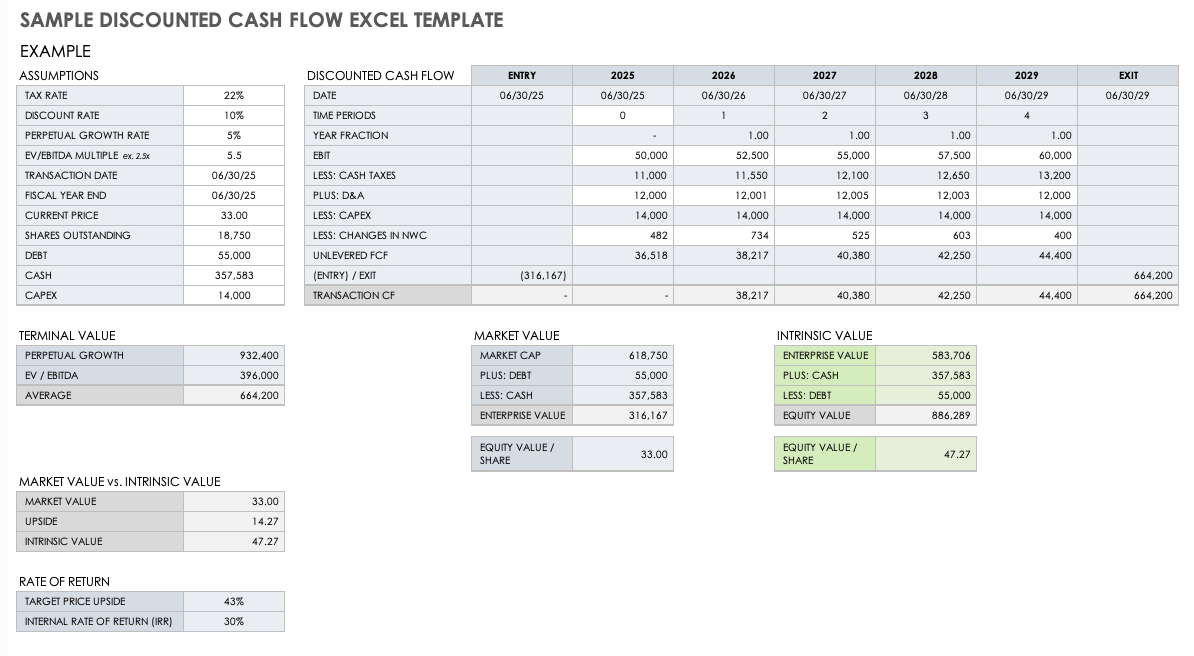

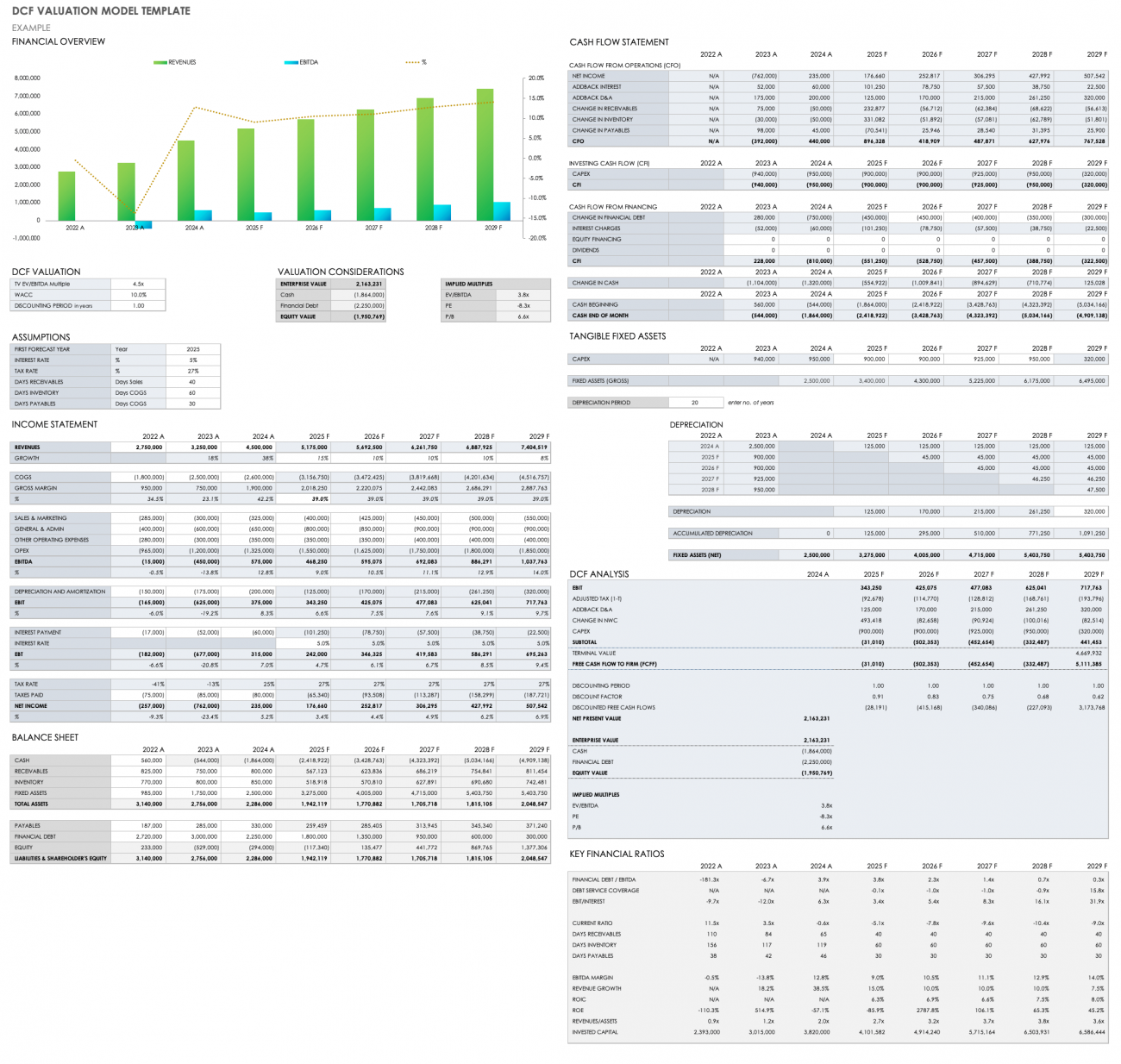

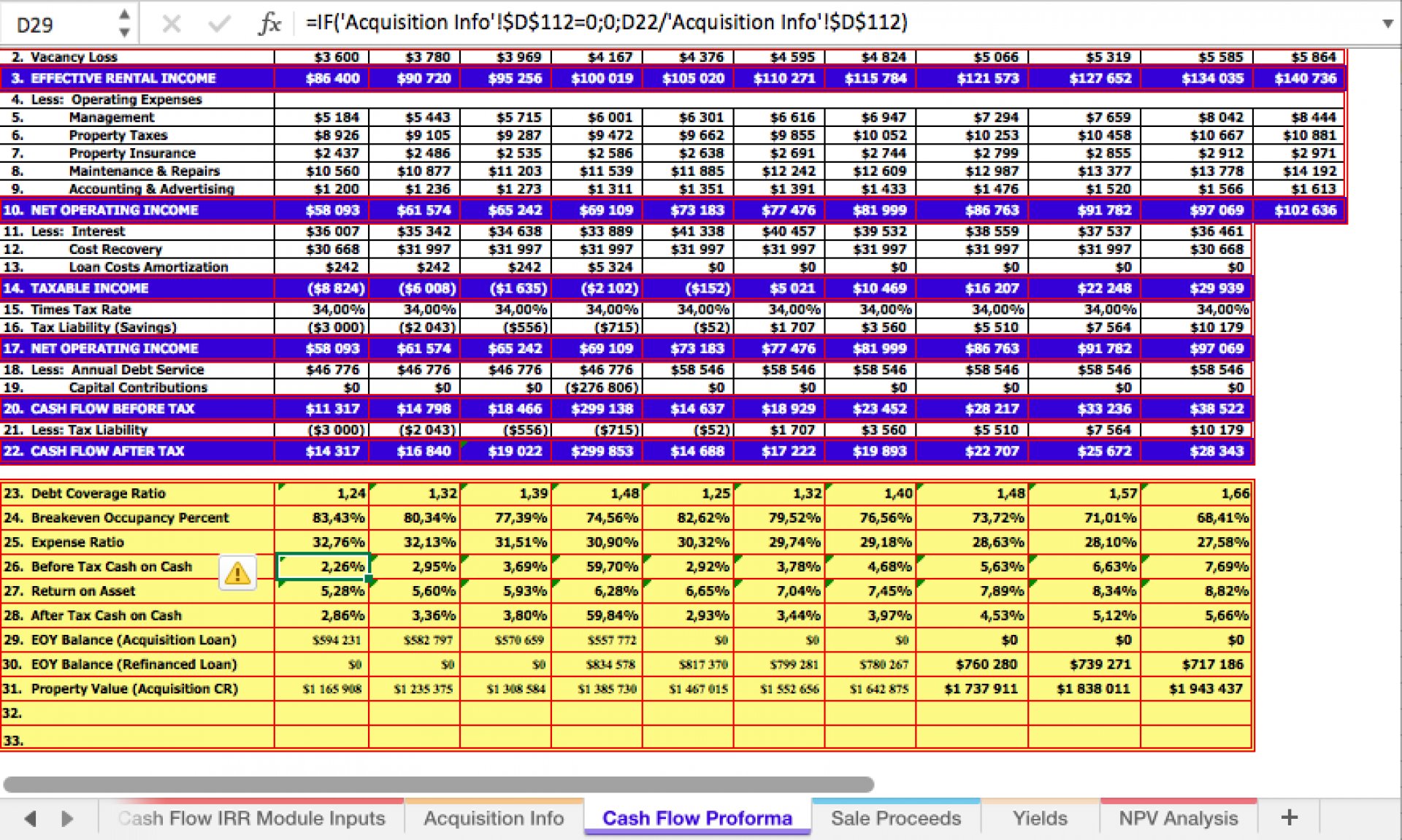

How do you calculate discounted cash flows?. Discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. What is discounted cash flow? We have built models for virtually every real estate property type (e.g. Dcf is basically used to calculate the present value of the cash flow of the company.

How To Use Excel To Calculate Discounted Cash Flow Rate Of Return

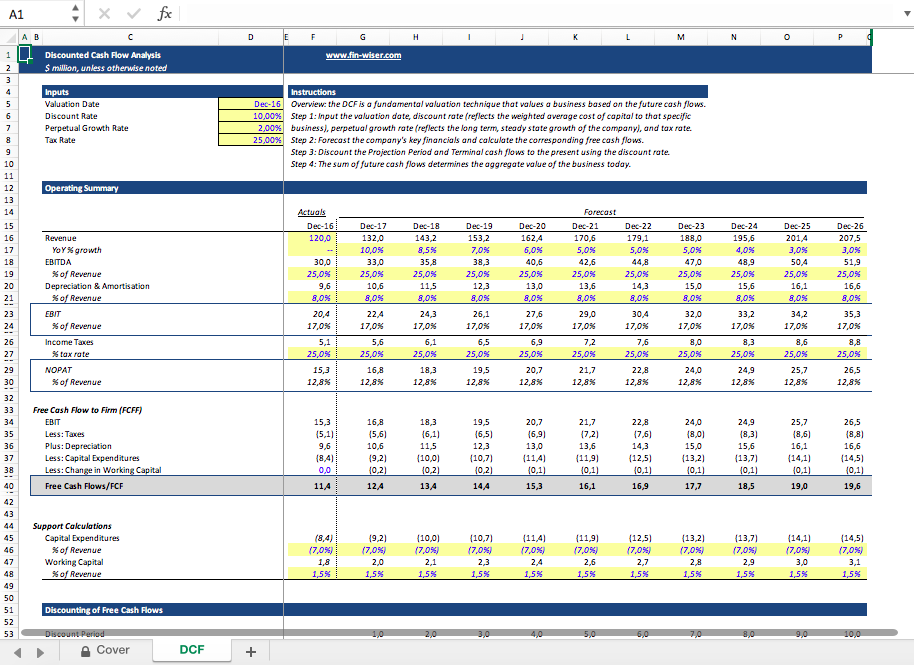

=npv(discount rate, series of cash flows) this formula assumes that all cash flows received are spread over equal time periods, whether years, quarters, months, or otherwise. “year”, “cash flow”, “discount rate”, “present value factor”, and “discounted cash flow”. The procedure is used for real estate valuation and consists of three steps: Dcf stands for d iscounted c ash f low,.

12 Discounted Cash Flow Template Excel Excel Templates Excel Templates

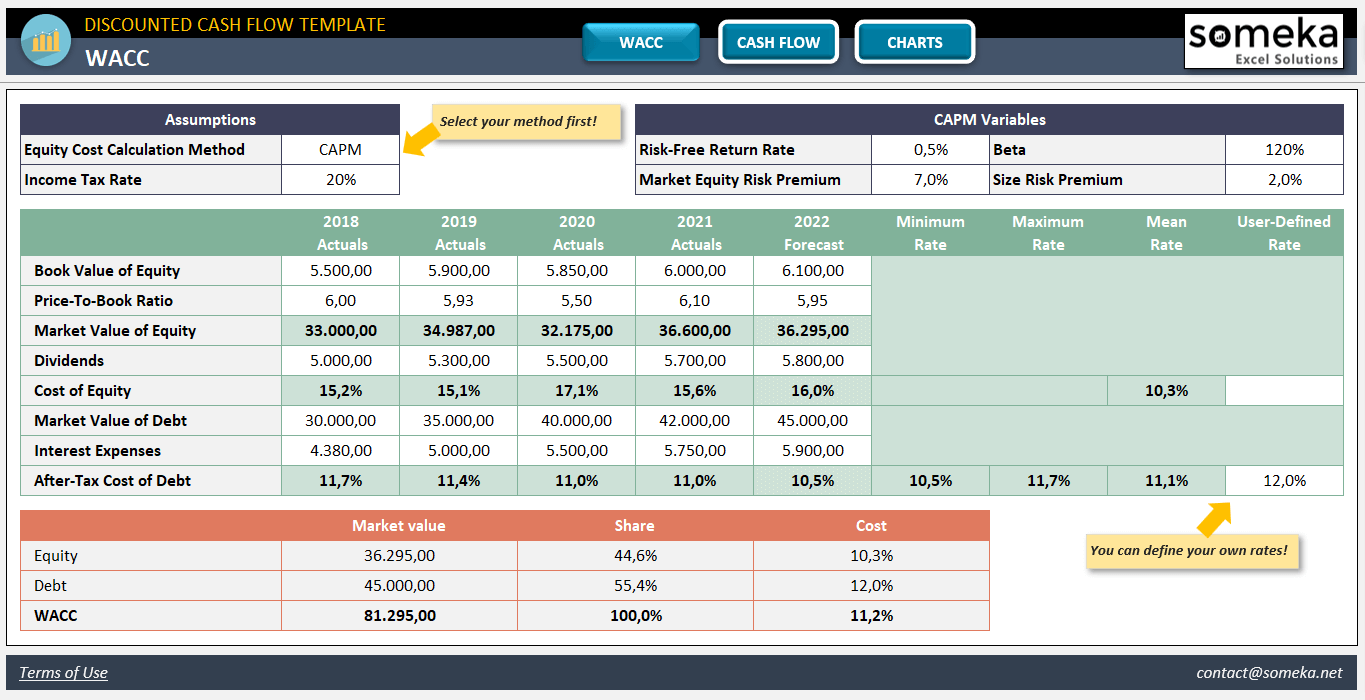

This template allows you to build your own discounted cash flow model with different assumptions. Web dcf stands for discounted cash flow. In brief, the time value of money concept assumes that one dollar in the future is worth less than today’s dollar. In this article accounts payable template download accounts payable template excel | smartsheet Web our discounted cash.

12 Discounted Cash Flow Template Excel Excel Templates Excel Templates

Dcf=cft/ (1+r)t here, cft = cash flow in period t (time) r = discount rate t = period of time (1,2,3,……,n) discounted cash flow (dcf) vs. Web discounted cash flows allows you to value your holdings today based on cash flows to be generated over the future period. Net present value (npv) the discounted cash flow ( dcf) is often.

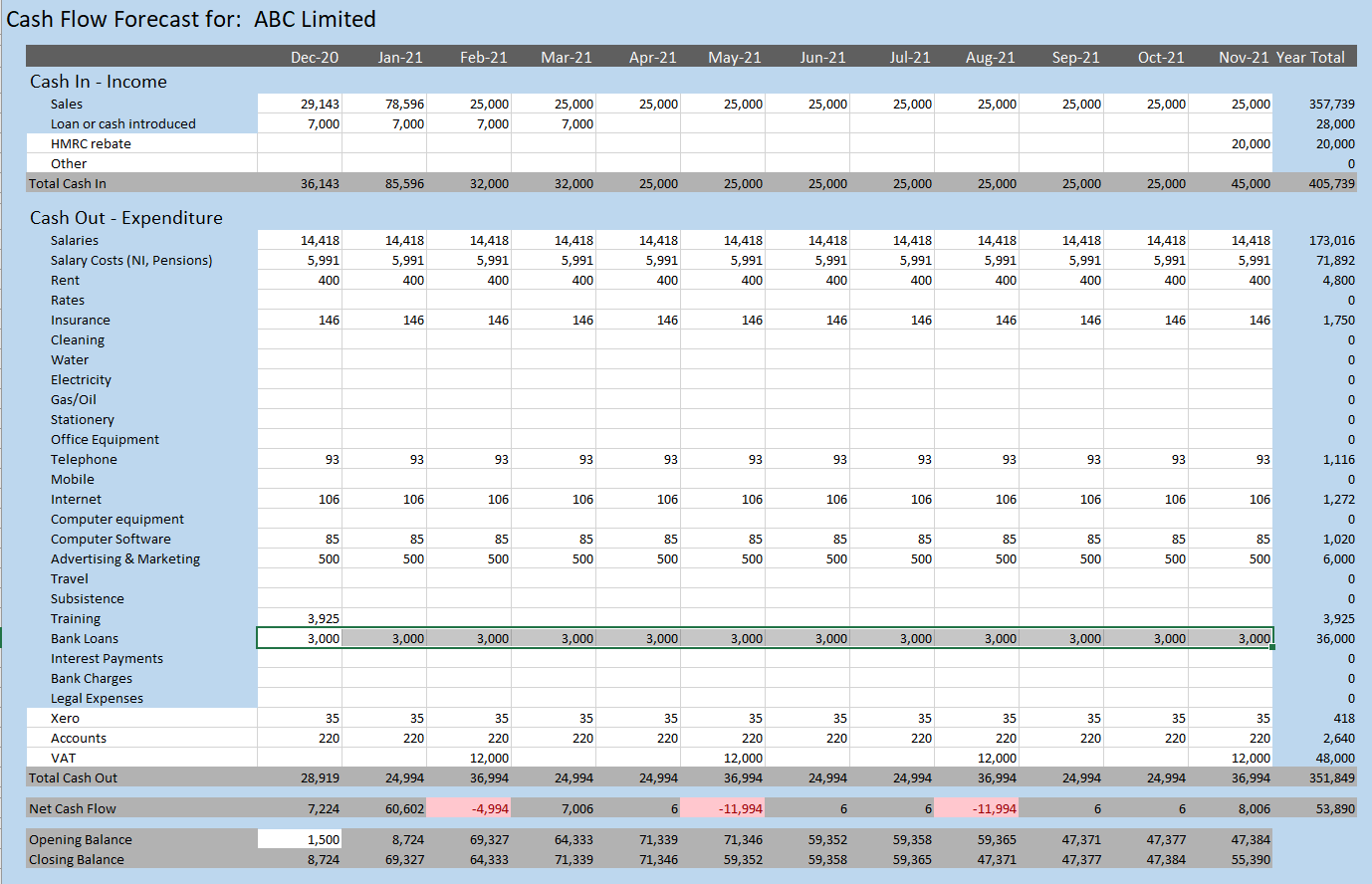

7 Cash Flow Analysis Template Excel Excel Templates

Retail, industrial, office, multifamily, hotel, etc), investment type (e.g. =npv(discount rate, series of cash flows) this formula assumes that all cash flows received are spread over equal time periods, whether years, quarters, months, or otherwise. “year”, “cash flow”, “discount rate”, “present value factor”, and “discounted cash flow”. Web we’ve compiled the most useful free discounted cash flow (dcf) templates, including.

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

It can guess the value of an investment based on expected cash flows.in other words, the dcf model tries to predict the value of investment today. Web discounted cash flow valuation model: Web dcf stands for discounted cash flow. Web we’ve compiled the most useful free discounted cash flow (dcf) templates, including customizable templates for determining a company’s intrinsic value,.

Real Estate Cash Flow Analysis Spreadsheet —

Net present value (npv) the discounted cash flow ( dcf) is often mixed with the concept of net present value ( npv ). Web here’s a template for a discounted cash flow (dcf) analysis excel sheet: Retail, industrial, office, multifamily, hotel, etc), investment type (e.g. We have built models for virtually every real estate property type (e.g. Dcfs are widely.

Cash Flow Excel Template Download from Xlteq

This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Download wso's free discounted cash flow (dcf) model template below! In this article accounts payable template download accounts payable template excel | smartsheet In the “year” column, list the years of the projected cash flows. It can guess the value.

Excel Discounted Cash Flow (DCF) Analysis Model with IRR and NPV Eloquens

What is discounted cash flow? Web the discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a current, present value. Below is a preview of the dcf model template: Web financial model templates which contain a dcf model. We have built.

The procedure is used for real estate valuation and consists of three steps: In the “year” column, list the years of the projected cash flows. Net present value (npv) the discounted cash flow ( dcf) is often mixed with the concept of net present value ( npv ). =npv(discount rate, series of cash flows) this formula assumes that all cash flows received are spread over equal time periods, whether years, quarters, months, or otherwise. Web financial model templates which contain a dcf model. Forecast the expected future cash flows. Dcf=cft/ (1+r)t here, cft = cash flow in period t (time) r = discount rate t = period of time (1,2,3,……,n) discounted cash flow (dcf) vs. This course is designed for students who want to learn company valuation methods especially discounted cash flow model. Dcf models discount expected free cash flows and calculate their net present value (npv). Web all models are built in microsoft excel 2013 or newer. What is discounted cash flow? The macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. It computes the perpetuity growth rate implied by the terminal multiple method and vice versa, and sensitizes the analysis over a range of assumed terminal multiples and perpetuity growth rates without the use of slow. Enter your name and email in the form below and download the free template now! Retail, industrial, office, multifamily, hotel, etc), investment type (e.g. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. In this article, we are going to explain how to calculate the dcf valuation result using a discounted cash flow analysis example. The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. It can guess the value of an investment based on expected cash flows.in other words, the dcf model tries to predict the value of investment today. Web here’s a template for a discounted cash flow (dcf) analysis excel sheet: