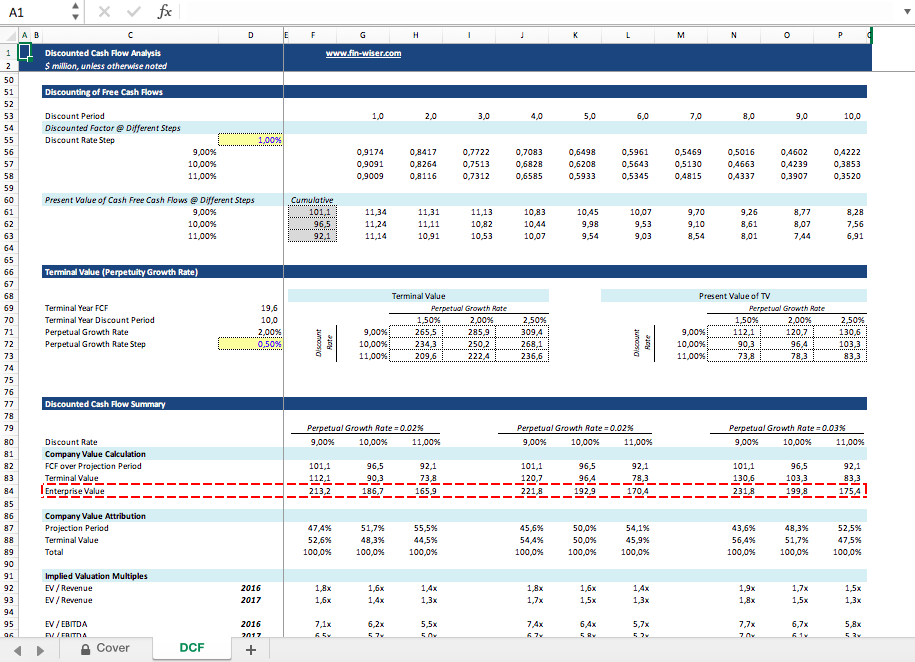

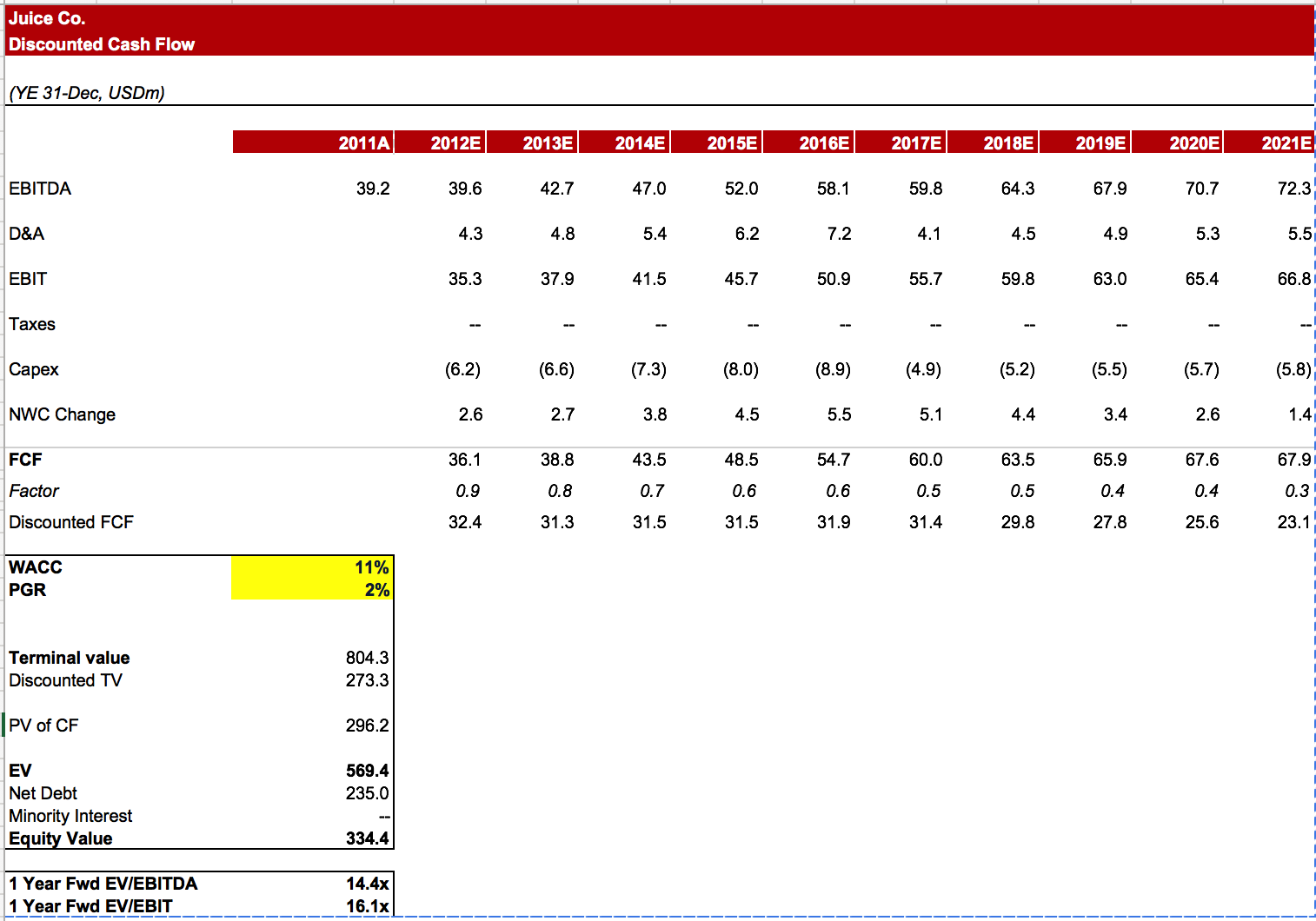

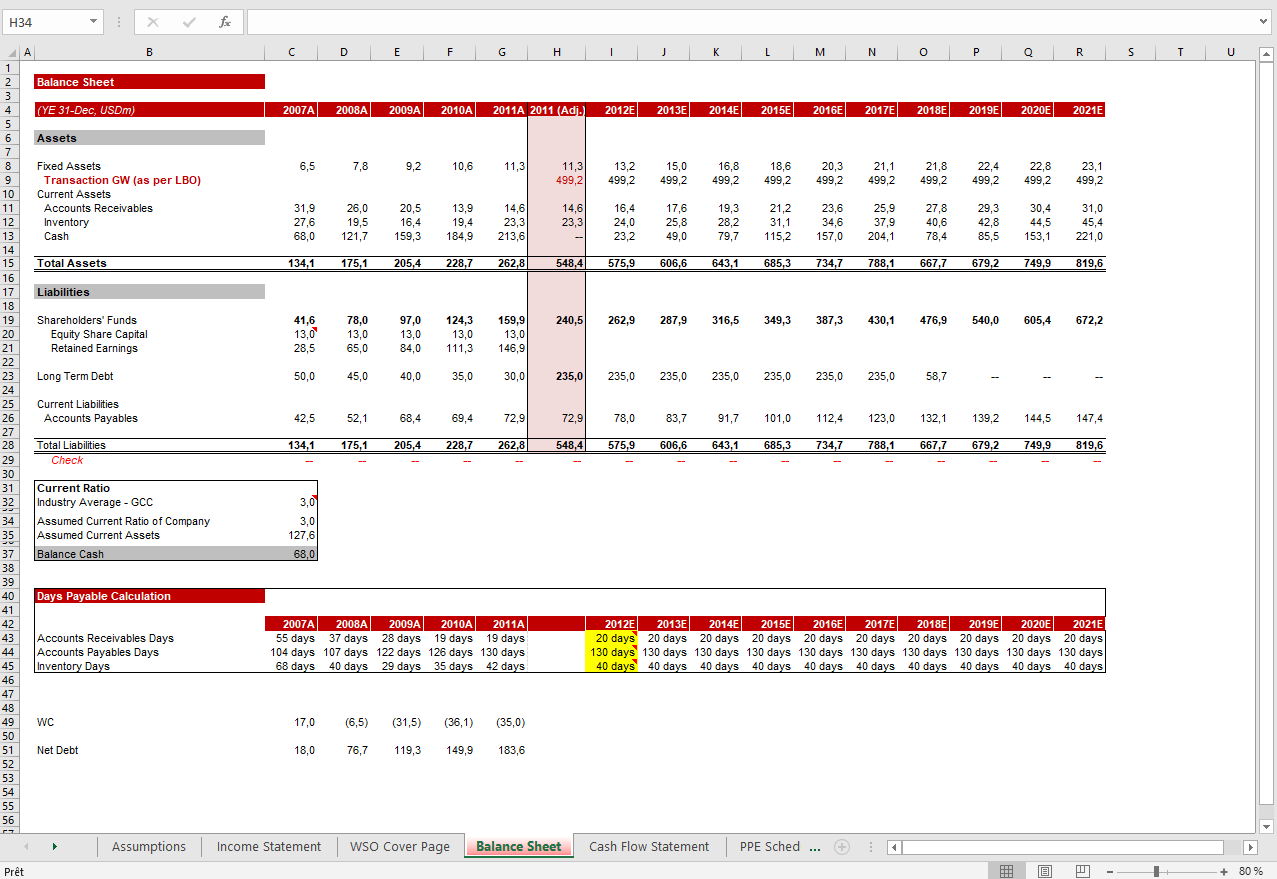

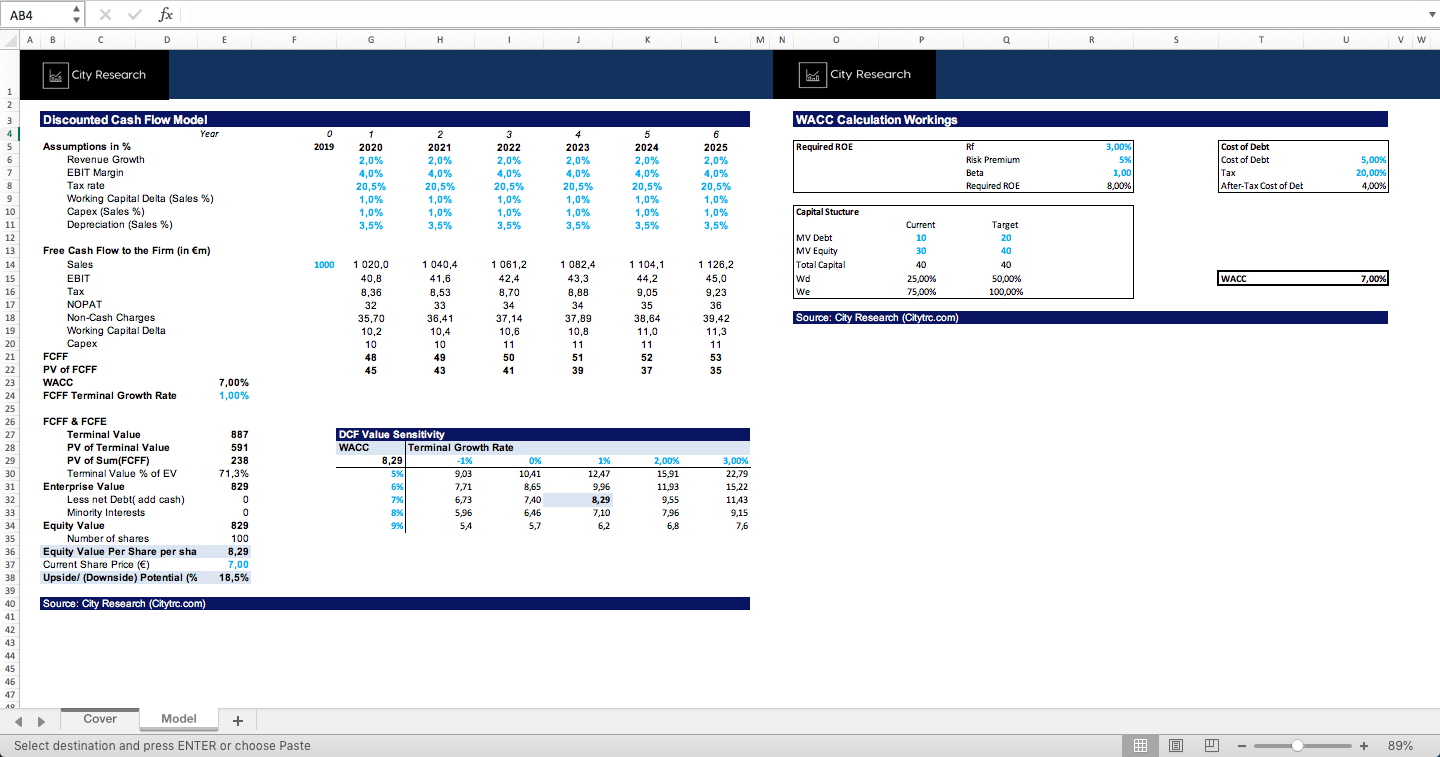

Simple Dcf Excel Template - Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. Web use the form below to download our sample dcf model template: Web a basic dcf model involves projecting future cash flows and discounting them back to the present using a discount rate that reflects the riskiness of the capital. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Download wso's free discounted cash flow (dcf) model template below! Below is a preview of the dcf model template: Web this dcf valuation model free excel template allows users to smoothly understand how to calculate enterprise value, also known as the net present value, by discounting the. Web the dcf model is useful in excel to carry out the time value of money. Download and customize them to fit your needs. What is discounted cash flow?

DCF Model Training 6 Steps to Building a DCF Model in Excel 네이버 블로그

Web the dcf model is useful in excel to carry out the time value of money. Web use the form below to download our sample dcf model template: This template allows you to build your own discounted cash flow model with. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. Download wso's free discounted cash.

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

The purpose of the discounted free cash flow financial model template is to provide the. What is discounted cash flow? Fv = pv x [ 1 + (i / n) ] (n x t) for example, assume. Web here’s a template for a discounted cash flow (dcf) analysis excel sheet: Download wso's free discounted cash flow (dcf) model template below!

Real Estate Dcf Excel Template

Start with a free account to. It includes an example to help you apply the. Get powerful, streamlined insights into your company’s finances. Web this dcf valuation model free excel template allows users to smoothly understand how to calculate enterprise value, also known as the net present value, by discounting the. Web dcf template discount factor terminal value value of.

DCF model tutorial with free Excel

The formula to calculate the time value of money is; It includes an example to help you apply the. Download and customize them to fit your needs. Below is a preview of the dcf model template: Enter your name and email in the form below and download the free template now!

DCF Model Full Guide, Excel Templates, and Video Tutorial

Web the dcf model is useful in excel to carry out the time value of money. Start with a free account to. Below is a preview of the dcf model template: Start by creating a table with the following columns: Web here’s a template for a discounted cash flow (dcf) analysis excel sheet:

![Free DCF Template Excel [Download & Guide] Wisesheets Blog](https://cdn-eaclf.nitrocdn.com/osNuHhBvVdZeEkSNJhSMrIuyqQJMcjPL/assets/static/optimized/rev-09e077f/wp-content/uploads/2022/07/Screen-Shot-2022-07-03-at-11.57.05-AM-1024x539.png)

Free DCF Template Excel [Download & Guide] Wisesheets Blog

Web a free guide on how to build dcf models in excel. Web use the form below to download our sample dcf model template: Enter your name and email in the form below and download the free template now! Web the dcf model is useful in excel to carry out the time value of money. Start with a free account.

Dcf Model Template

Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Web a basic dcf model involves projecting future cash flows and discounting them back to the present using a discount rate that reflects the riskiness of the capital. Web a free guide on.

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Cash flow (cf) (cf) represents the net cash payments an investor receives in a given period for owning a given security (bonds, shares, etc.) when building a financial model. Web a basic dcf model involves projecting future cash flows and discounting them back to the present using a discount rate that reflects the riskiness of the capital. Below is a.

How To Use Excel To Calculate Discounted Cash Flow Rate Of Return

Get powerful, streamlined insights into your company’s finances. Cash flow (cf) (cf) represents the net cash payments an investor receives in a given period for owning a given security (bonds, shares, etc.) when building a financial model. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the.

Simple Discounted Cashflow (DCF) Excel Model Template Eloquens

Web dcf template discount factor terminal value value of asset conclusion summary text this video opens with an explanation of the objective of a discounted cash flow (“dcf”). The purpose of the discounted free cash flow financial model template is to provide the. It includes an example to help you apply the. Start with a free account to. Web to.

What is discounted cash flow? Below is a preview of the dcf model template: Web the dcf model is useful in excel to carry out the time value of money. Download wso's free discounted cash flow (dcf) model template below! Web use the form below to download our sample dcf model template: Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Start with a free account to. Web discounted cash flow template. Web a basic dcf model involves projecting future cash flows and discounting them back to the present using a discount rate that reflects the riskiness of the capital. Cash flow (cf) (cf) represents the net cash payments an investor receives in a given period for owning a given security (bonds, shares, etc.) when building a financial model. Web dcf template discount factor terminal value value of asset conclusion summary text this video opens with an explanation of the objective of a discounted cash flow (“dcf”). Web to help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Fv = pv x [ 1 + (i / n) ] (n x t) for example, assume. Enter your name and email in the form below and download the free template now! The formula to calculate the time value of money is; This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Web here’s a template for a discounted cash flow (dcf) analysis excel sheet: This template allows you to build your own discounted cash flow model with. It includes an example to help you apply the. Web a free guide on how to build dcf models in excel.