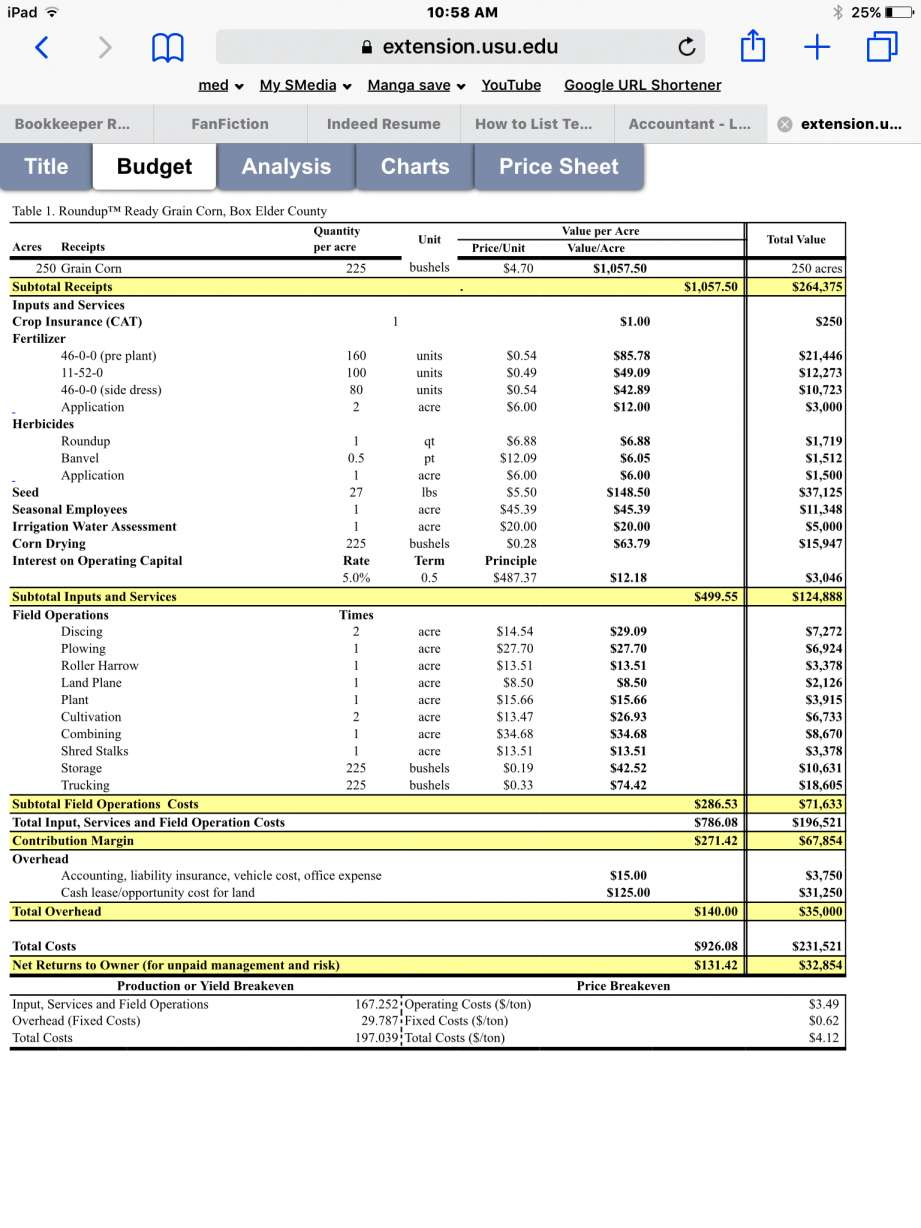

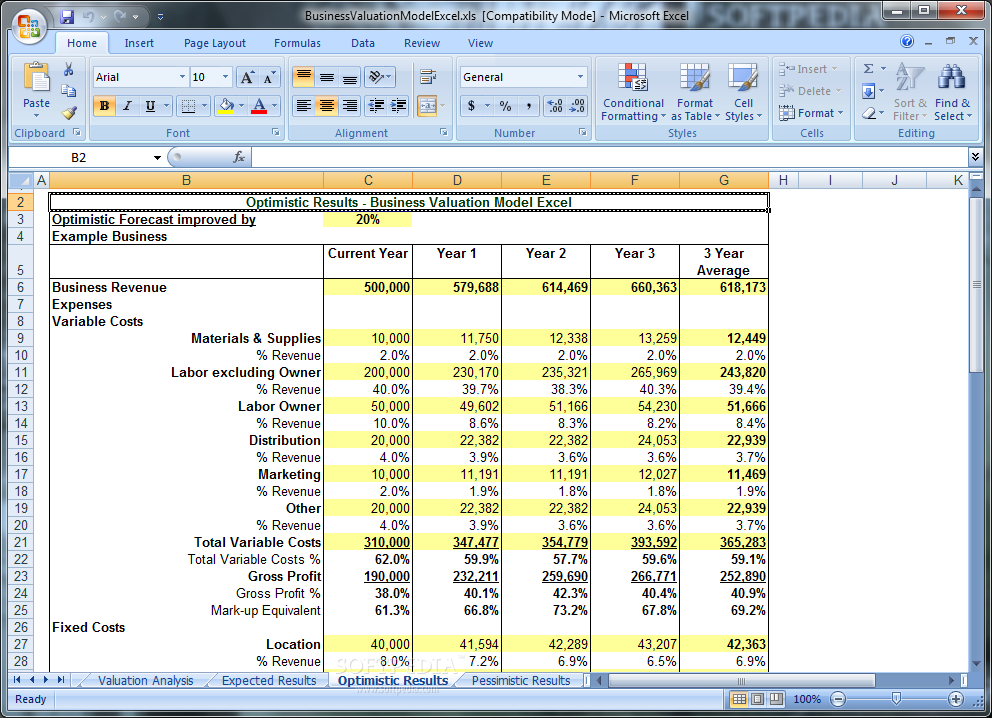

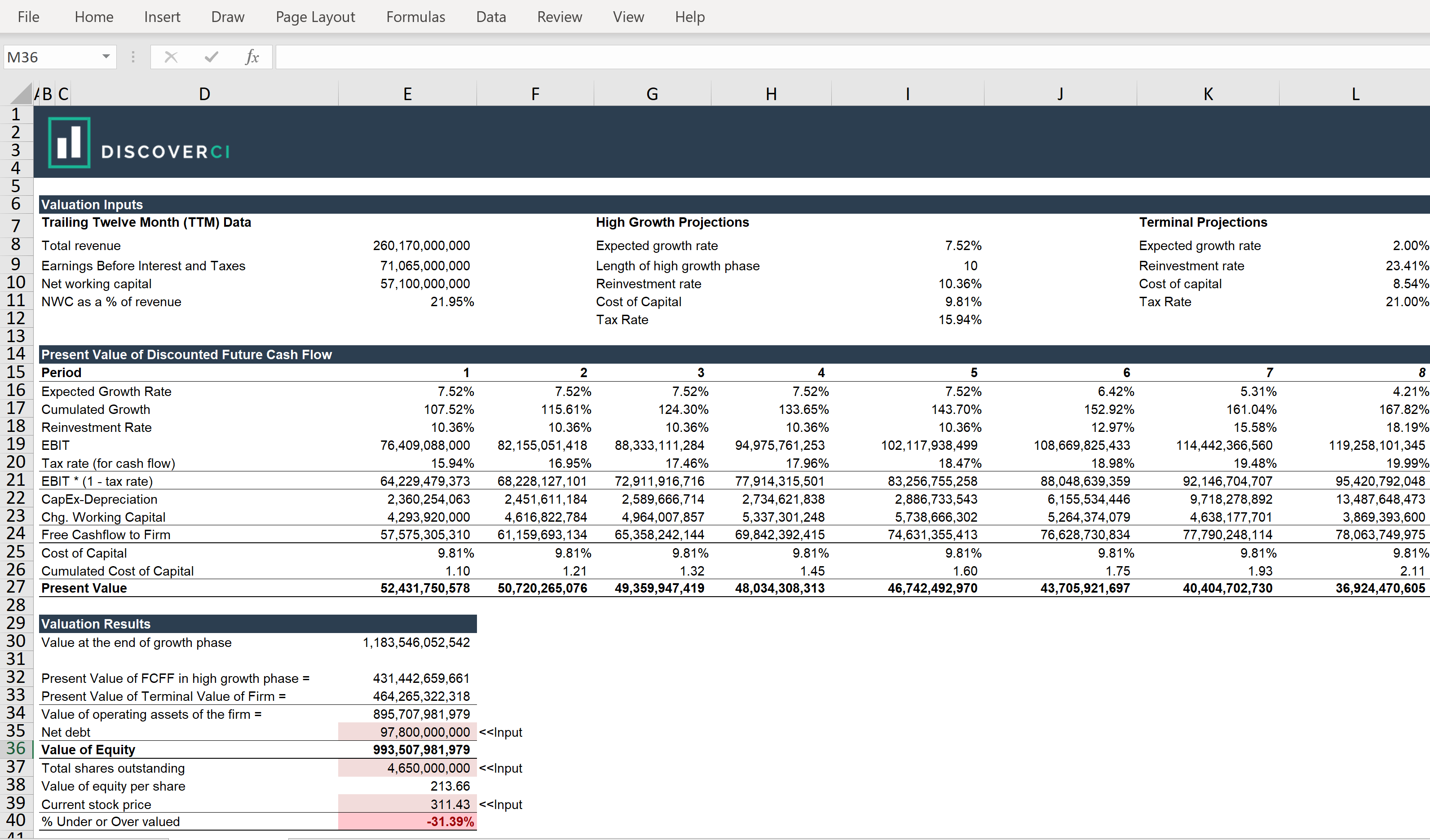

Valuation Model Excel Template - This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company based on the discounted cash flow (dcf) method by using the weighted average cost of capital (wacc) as a discount rate for future cash flow projections over three and five year periods. Using a firm’s balance sheet and income statement, one could easily calculate its valuation metrics. Learn financial modeling techniques with fundamental analysis to value a company and design 3 financial statements. Sample discounted cash flow excel template. 1 review 807 views | start the discussion! Create a valuation report on a building, small business company, land, capital gain, stock, machinery, residential property, bank, and more. The premium version also includes a valuation report template for real estate brokers wishing to use this model. Web this real estate excel template comes in a basic, pro, and premium version. English [auto] what you'll learn. Here is a preview of the template:

Download Microsoft Excel Business Valuation Template Fr...

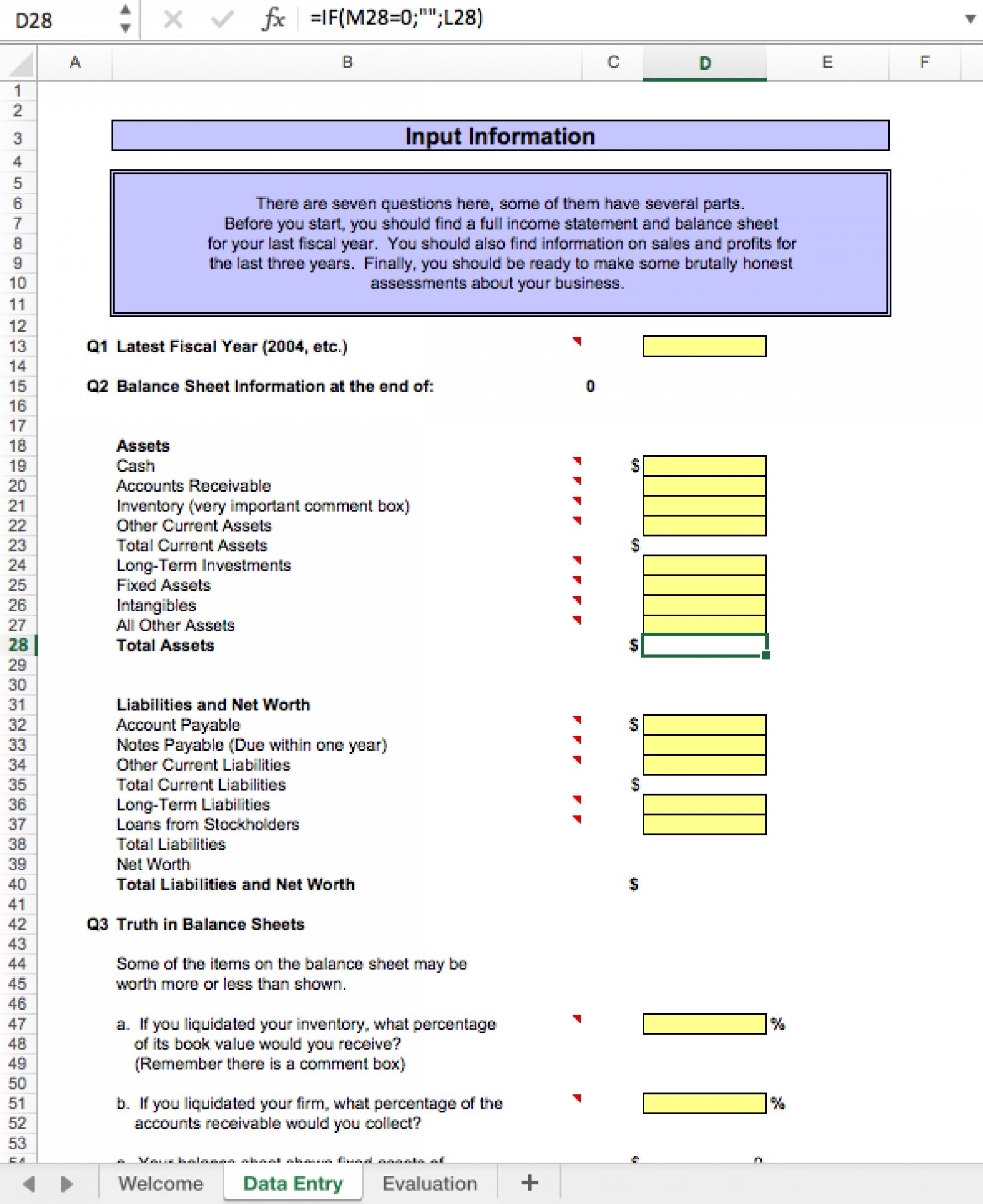

Determining the value of your business is the starting point to building value. Valuation modeling in excel may refer to several different types of analysis, including discounted cash flow (dcf) analysis, comparable trading multiples, precedent transactions, and ratios such as vertical and horizontal analysis. Web written by cfi team. Commercial real estate properties, financial model, investment, real estate. Here is.

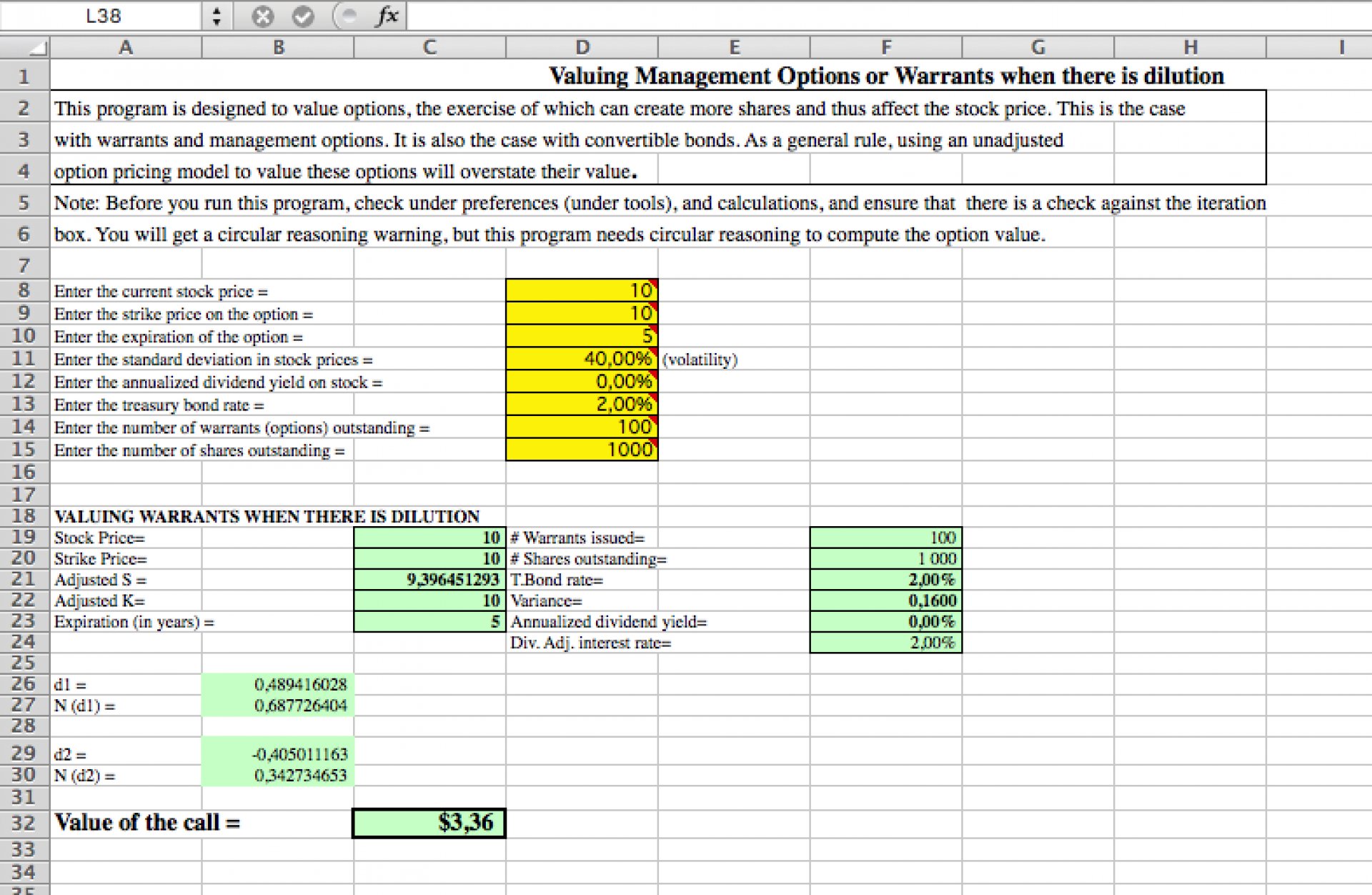

Warrants and Management Options Excel Valuation Model Eloquens

Learn financial modeling techniques with fundamental analysis to value a company and design 3 financial statements. This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company based on the discounted cash flow (dcf) method by using the weighted average cost of capital (wacc) as a discount rate for future.

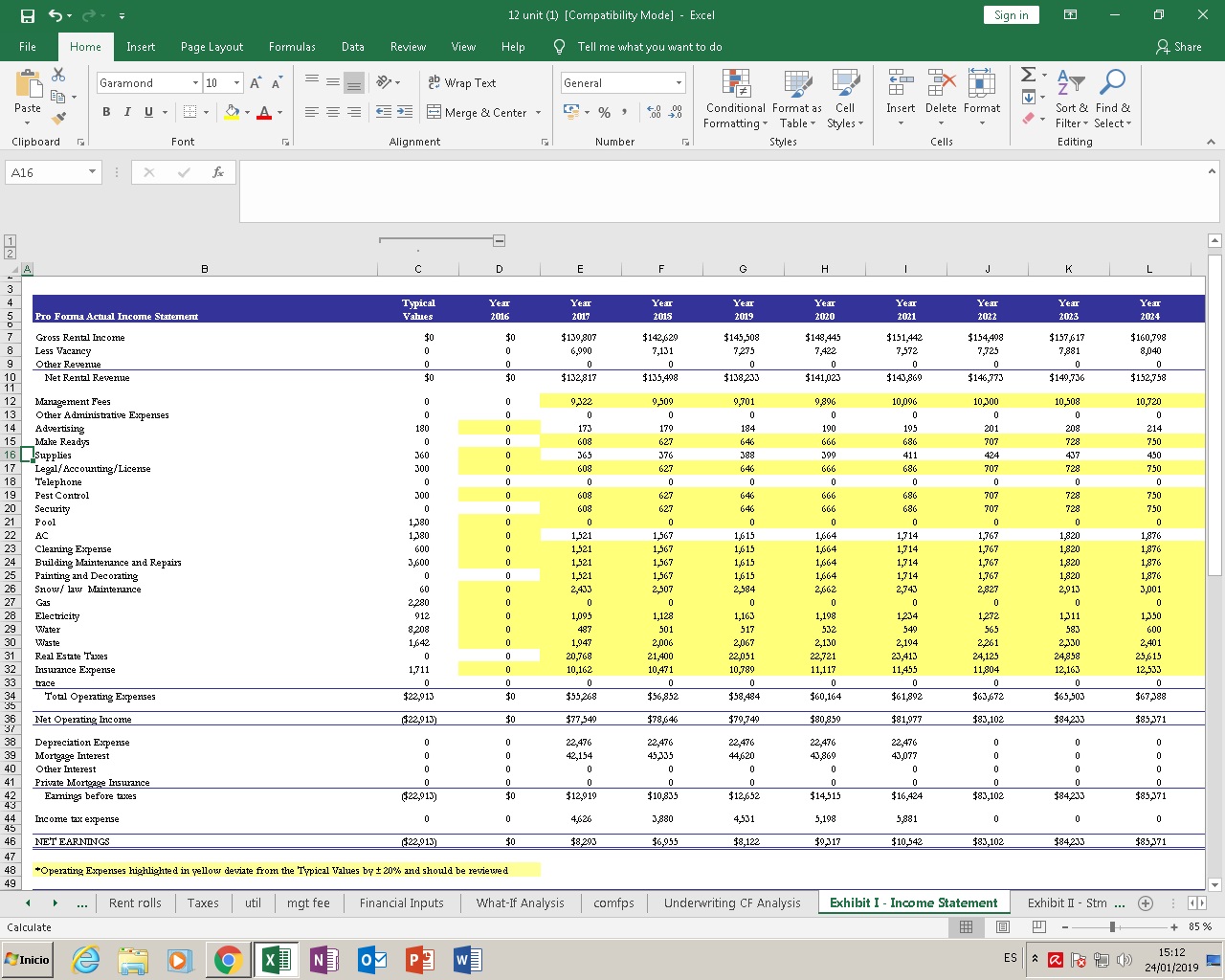

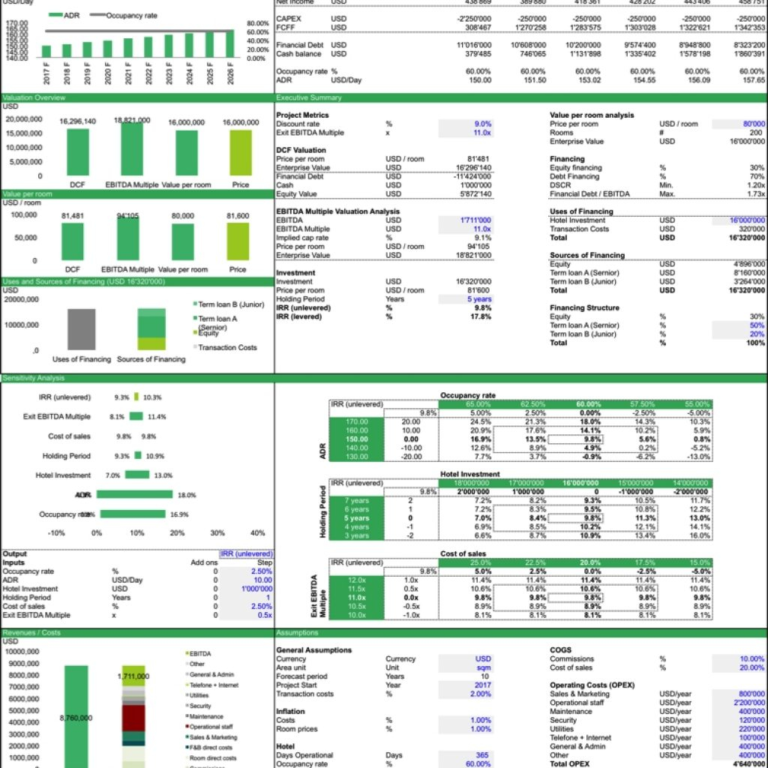

Real Estate Financial Model Excel Template for Complete Valuation with

1 review 807 views | start the discussion! Web a complete fcfe valuation model that allows you to capital r&d and deal with options in the context of a valuation model. This excel template illustrates how to calculate the following multiples: Such as a discounted cash flow valuation analysis (dcf), residual value, replacement costs, market comparables, recent transaction comparables, etc..

Download Business Valuation Model Excel 60

Web valuation model excel templates 1 comment. 1 review 807 views | start the discussion! Web due to the importance of a valuation report, it certainly pays to know how to come up with this document in the best way possible. They typically indicate the intrinsic value per 1 common share of a firm’s outstanding stock. Examples of assets are.

Fress Stock Valuation Spreadsheet Template DiscoverCI

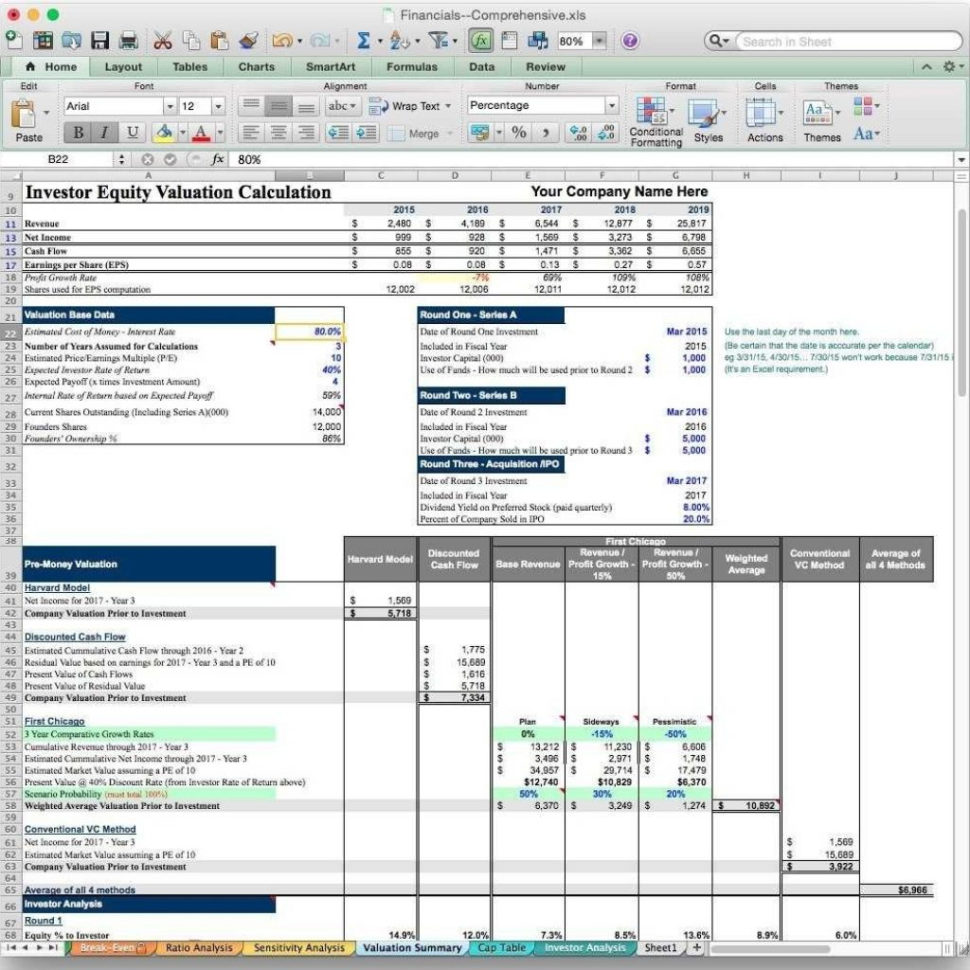

Learn financial modeling techniques with fundamental analysis to value a company and design 3 financial statements. The premise of the dcf model is that the value of a business is purely a function of its future cash flows. It involves estimating future cash flows until the end of the forecast period and is an intrinsic value approach. Pre money post.

Business Valuation Template Excel Free Printable Templates

1 review 807 views | start the discussion! Learn financial modeling techniques with fundamental analysis to value a company and design 3 financial statements. Such as a discounted cash flow valuation analysis (dcf), residual value, replacement costs, market comparables, recent transaction comparables, etc. This template allows you to create your own adjusted present value calculation for a company. Download wso's.

Business Valuation Spreadsheet Template for Business Valuation

What's inside the property valuation calculator? English [auto] what you'll learn. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. They typically indicate the intrinsic value per 1 common share of a firm’s outstanding stock. This excel model includes the principal methods for the valuation of a company.

12 Real Estate Excel Templates Excel Templates

This template allows you to create your own adjusted present value calculation for a company. Web a complete fcfe valuation model that allows you to capital r&d and deal with options in the context of a valuation model. The premise of the dcf model is that the value of a business is purely a function of its future cash flows..

Free Excel Business Valuation Spreadsheet —

Concerning liabilities, they can be bonds issued by a. Certain key components need to be included, such as the purpose of the valuation, the date of valuation and issuance, asset descriptions, data analysis, and the valuation method.to make your experience easier and faster, it is. Dcf analysis is a staple of financial modeling and can be performed with a basic.

Company Valuation Model

This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Web valuation model excel templates 1 comment. The premium version also includes a valuation report template for real estate brokers wishing to use this model. Web due to the importance of a valuation report, it certainly pays to know how.

Web valuation analysis excel model template. Valuation modeling in excel may refer to several different types of analysis, including discounted cash flow (dcf) analysis, comparable trading multiples, precedent transactions, and ratios such as vertical and horizontal analysis. How to build a dcf model: Below is a preview of the dcf model template: Create a valuation report on a building, small business company, land, capital gain, stock, machinery, residential property, bank, and more. This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company based on the discounted cash flow (dcf) method by using the weighted average cost of capital (wacc) as a discount rate for future cash flow projections over three and five year periods. Determining the value of your business is the starting point to building value. Web written by cfi team. Web get the free excel free cash flow to equity template to learn more about how the final piece of the valuation model works. This excel model includes the principal methods for the valuation of a company. The premium version also includes a valuation report template for real estate brokers wishing to use this model. Pre money post money valuation analysis template. Here is a preview of the template: Web calculate your investment, monthly cash flow, monthly expenses and roi on a real estate purchase with our property valuation excel template. Commercial real estate properties, financial model, investment, real estate. This program provides a rough guide to which discounted cash flow model may be best suited to your firm. Web 11+ investment evaluation report templates in pdf | word. Such as a discounted cash flow valuation analysis (dcf), residual value, replacement costs, market comparables, recent transaction comparables, etc. Web written by cfi team. Supported versions (all features) | excel 2016, 2019, office 365 (mac)